Thai share buy backs are at record high levels, but not reported.

See here below as I write today to the BKK Post, concerning Thai share buy backs, which its article is very misleading and totally incomplete, not doubt done by a non-pro. It alludes "20 companies will likely buy back their own shares", when in fact many dozens are doing this already! Which needs correcting if only as a good deed, basis, as the many share buy-backs of lately do show senior mgt. of these firms believe their stock prices are way too cheap.

Regarding the BKK Post Biz. article today on: "Twenty listed firms seen likely to prep share buybacks".

Over the past year or so there have been far, far more than just twenty Thai listed companies which have already announced and regularly buy-back their own shares on the SET/MAI. As is then regularly SET-news announced, but never tallied-up to actually show how many different companies are doing this already.

The SET or their brokers, should publish the number of companies and even their names -as its a true positive sign in that these mostly do believe their share prices are oversold and below intrinsic value. While sometimes a company may buy back their shares as they do not see alternative good investments at present with their cash on hand; however most of the time it's a clear sign believing current mkt. prices well under priced their true value. Its a positive sign when soo many companies announce buy backs, and this should be published by the SET or brokers. As is now, nobody really knows the actual number which I estimate to be in the many dozens. ***

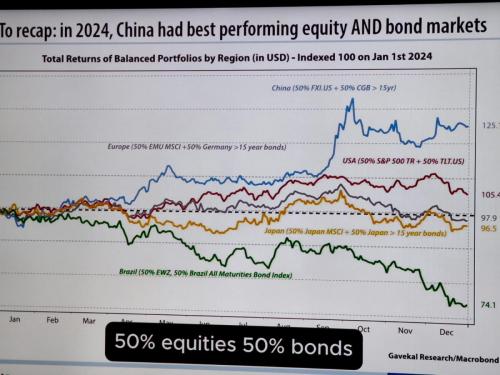

Separately, then there is the continued often Western promoted China bashing which regularly under reports how well China and HongKong stocks have been doing of late. For example, here is a statement by Michael Fritzel at Asiancenturystocks.com which just wrote: "we’ll finally see a bull market in Europe, or perhaps in China, or somewhere else..." Further stating YTD China having outperformed, but failing to say it did the same last year. In fact: China stocks & bonds, have broadly beaten the US mkt last year, as well as this year....as well as return on Gold during the same time. With some cherry picks, like XIAOMI which has tippled in value since I here first viewed very favorably last June 2024.

Best Regards,

Paul A. Renaud. www.thaistocks.com