TOG reports solid 4 Q. and so full year 2024, as expected.

TOG (Thai Optical Group) reported late on Friday Feb. 28th, its 4Q and full year 2024 financial results. As expected and here predicted they were very good. In fact, if you factor in its higher new depreciation & interest (& tax expenses), due to its higher profit margin Fx lenses 20% capacity expansion last year, it was a record Quarter in net profit (So called EBIT).

Total revenues soared in calendar year 2024 to 3.51 Bill. compared to 3.01 Bill. Baht for year 2023 -which itself was a new record revenue year. Year 2024 saw a 16.5% revenue, "top line", increase last year. Impressive as in the past "tame top-line growth" projections was being questioned by some analysts.

Consider: double total revenues' now compared to year 2020 (just before Covit) as back then it was 1.84 Bill. Since 2020, net profit and EPS have quadrupled even while TOG stock price “only” doubled. Yet see here the graph how TOG vastly outpeformed its sector and the SET index by triple digit % !

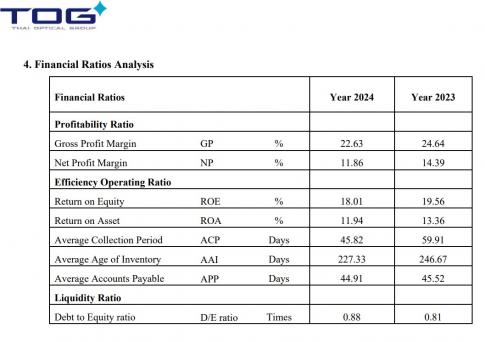

TOG’s net profit margin dropped some last year from 14.1% to 11.7%, mostly due to much higher depreciation on new capacity expansion, interest -and higher corporate taxes. (Short-term loans from banks increased by 99 million Baht and long term loans increased by 157 mill. Baht -while Income taxes increased by 17 million Baht in year 2024).

As noted previously, last year TOG completed an ambitious and timely Fx lenses' factory production capacity expansion. Financed mostly via new Bank loans which carry a relatively low 2.5 to 2.8% interest rate. Its full benefit on increased sales will be realized this year, hence I predict revenues to likely increase to 4 Bill for year 2025. The company previously stated -continued due to strong global demand -further expanding some production capacity via a factory in Vietnam this year. TOG exports some 96% its otal revenues.

Due to strong global demand (especially from the US) requiring new capital to finance this capacity expansion, the company in lieu of this decided to pay a 0.25 Baht final dividend on top of the 0.20 dividend paid last August, or for a total of 0.45 Baht per share, so to current dividend yield of 4.7% on the current stock price. This is lower then the 0.65 Baht per share paid the previous year. But, to medium and longer-term investors its good news as this now very likely means no capital increase planned -and so no share dilution. I think its high cash flow besides already secured bank loans -as duly noted at low interest rates- will finance their/this continued expansion and so in time, this year, yet another new record in EBIT, or likely even net profit. I here with confidence predict. (Assuming no global or US recession).

I duly noted, higher margin Rx/Prescription Lenses increased by 15% vs. the year before. (From 39% to 45% of total revenues.) In 2024 TOG and its subsidiaries had ratio of cost of goods sold to revenue from sales and services at 77% higher than prior year only by 1%. "Expanded overseas warehouse service expenses, import expenses and travel expenses also contributed to higher expenses….but trade accounts receivable unrelated parties decreased by 96 million Baht mainly due to TOG being more efficient in managing outstanding receivables".

My new TOG profit estimate for this year is 1.05 Baht per share, or a calender 2025 year p/e, of barely 9. Far too tame for a defensive global diversified exporter in a relative defensive industry, much benefiting from aging demographics, baby-boomers global phenomena -and the emerging but little talked about Myopia generation. Hence my buy-view remains in place where still high dividends compensate for investor patience in an otherwise still bearish Thai stock market. Here and just toabe are some statements from their/TOG management discussion just released (in blue background):

“A tight labor market has prompted the company to focus on automation to reduce labor dependency. The company focuses on market diversification and expanding its customer base to reduce reliance on primary markets. Additionally, it actively manages foreign exchange risk by using financial instruments to stabilize revenue. Investments in technology and automation have been accelerated to enhance efficiency, reduce costs, and strengthen supply chain resilience. The company is also optimizing procurement management, alongside research and development, to reduce raw material costs and improve manufacturing efficiency…..

"In 2024, The Company and its subsidiaries had earned total revenues 3,516 million Baht, which was increased by 501 million Baht or 17% from previous year. The net profit for the period was 412 million Baht, which was decreased by 14 million Baht or 3% from the previous year.”

“In 2024, Sales revenue increased in all regions with the Americas increased by 46 percent, Canada increased by 31 percent, Africa and the Middle East increased by 41 percent, Europe increased by 13 percent, Asia and Pacific increased by 6 percent and increased in Australia increased by 1 percent. As for the cost of sales and services, the proportion to revenue from sales and services increased from the previous year, mainly due to higher raw material prices and production overhead costs, as well as depreciation from replacement machinery and additional investment. In terms of selling and administrative expenses, the increase was mainly due to oversea warehouse service expenses, import expenses, and travel expenses for business strategy.”

TOG, for many years already, gives regular “Opportunity Day” presentation to the SET and we so plan to learn more about that and then some and will share here....just announced its planned for March 14th. SET Oppt. Day on TOG is March 14th! https://listed-company-presentation.setgroup.or.th/en/vdo/9287

Best Regards,

Paul A. Renaud. www.thaistocks.com