AUCT/TOG both my medium term investor strong buy view. SICT-growth stock.

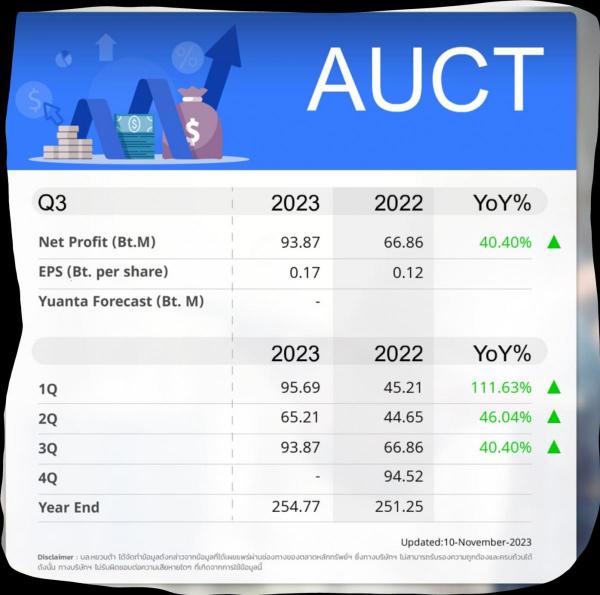

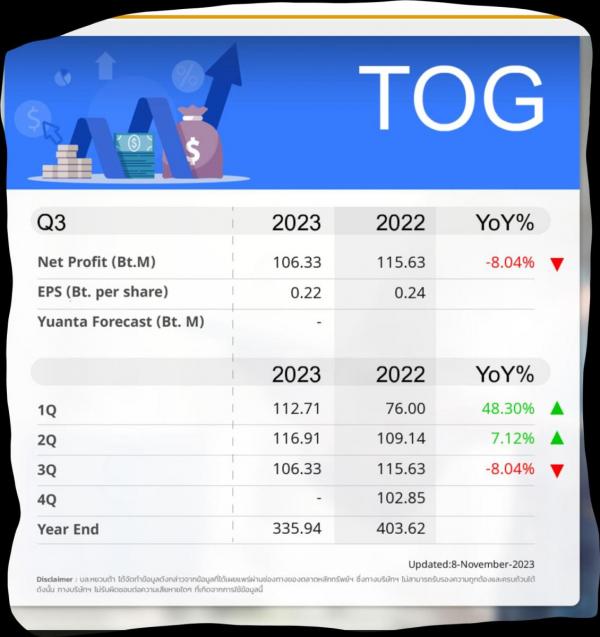

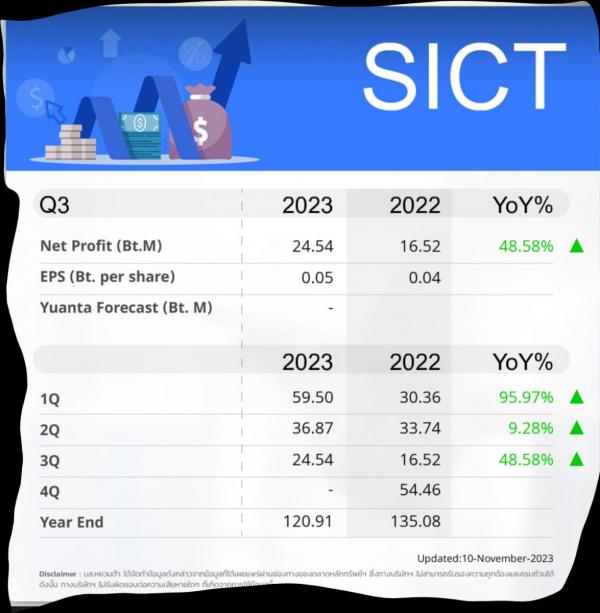

AUCT (10.30) just reports a fabulous 3 Q. earnings/financial statements. As I evaluate so did TOG (11.60), "steady as she goes" (see just previous article on TOG seperate). Hence, post these 3 third Q. reports this week, I so much reaffirm both AUCT/TOG as my medium term investor strong buy view, yes despite the ongoing lethargic SET. With SICT (6.85) which remains my growth stock selection. SICT also just reported solid earnings growth but trades at a higher p/e at 20 -and yields just about no dividends. (see last below). Combined I can see these 2 growing companies yielding over 5% in cash dividends going forward -or almost double the SET average dividend yield. I much believe at some point next year, either or all three of these key/core selections, should be worth 30% more, plus dividends. (Not SICT as no/little dividend expected here). TOG is more tame while SICT is my high growth stock choice but at higher valuation, so a bit more risky. Both benefit from any Thai Baht vs. Dollar, weakness.

This all assuming with a stated medium term investor objective seeking growth and high dividends during dire times. Again, TOG is more tame while SICT is the high growth stock choice but at higher valuation, so a bit more risky. This is now my new advocated/updated and here so restated investor view moving forward into year 2024! With the SET benchmark index today November 10, closing at 1389.

Here below are 3 pictures of their summary year to date and 3Q. financial reports: "a picture worth a thousand words" Much reaffirmed today post just reported financial 3 Q. results this week: