Remain TOG (12.20) Thai Optical Group bullish, Master report-part 2.

I start part 2 of this article on TOG (12.10), trying to identify the various risk factors regarding investing in TOG -from here on and going forward.

This post its 35% price rise in the 2Q. and doubling over the past 3 years + dividends, all since I first started pounding the table to members in April 2020. As mentioned before, TOG stock price rise is more then justified due to TOG’s earnings per share rising from 0.14 Baht per share in 2020 (from 0.48 in year 2019) to 0.85 Baht last year 2022, to very likely close to 1 Baht for this year, as the company already earned 0.48 for the first six months. Note, their 4thQ. is historically their seasonal best.

Hence TOG earnings (per share) have risen much faster than its stock price has -since April 2020. The current 2023 p/e is still a tame 12 vs. much higher back then, when earnings were lackluster. Further, this company now has a far bigger mkt. capitalization, more than doubling since then. As reviewed in my last article. Its market cap. doubled, while its p/e dropped some compared to averaging earnings back then, in those days. (See comment added after this article).

Macro risk factors which come to mind (members feel free to comment):

--Major global recession in the US/CHINA and so denting global demand across the board. (Less likely now than many perceived 3-6 months ago, in my view).

---Global competition in lenses being more serious than we think and so denting into the company’s growth rate along with price discounting, all resulting in Net Profit margin (NPM) deteriorating.

--Global instability increasing due to China/Russia upping the ante with their autocratic stern leaders. Also, next year US presidential election creating more than haywire due to Trump/Bidden unresolved anguish/turmoil/havoc.

--Global drought along with climate change increasing economic stress all around? I think this is less of a concern for TOG.

Of course, I am likely missing some as there also is always a risk of a new “black swan”. Like another Covit type or a lock down?

Micro risk which come to mind:

--TOG can’t bring on-line as now is planned its new Rx lenses expansion in 2024, 30% expansion slowed due to tests failing or other production problems, delays, with this. (not likely).

--Force majeure, like a fire or floods or some other very unforeseen events there. Illness or death of a key-executives?

--Major Thai political uprising creating large labor & logistic disruptions. But remember TOG exports 96% of total sales.

--Substantial rise in the Thai Baht currency vs. US$, which goes beyond their hedging insurance and so pricing power deteriorates affecting NPM. But not the opposite is happening so a positive for TOG.

--Raw material problems, shortages, price hikes beyond their control. Mgt. stated raw materials prices and availability are stable.

--Big drop in the SET index due to some major event(?), “black swan”. This happened of late but did not dent TOG stock price much. As likely maintain their high dividend will cushion as well as its low p/e, not least being a major exporter to 50 different countries -spread over 6 continents! TOG’s top 2-3 customers make up barely 10% of total sales (source their 2022 Annual report). Also, not Thai economy nor Thai consumer spending/tourist dependent. Again 96% of revenues generated from exports, so TOG be a Thai Baht depreciation beneficiary. A desirable trait to foreign investors whom want an investor hedge against Thai currency weakness.

-- Average trading volume on TOG is presently fairly low by institutional standards, as is its US$155mill. mkt cap. Only one broker cover research on TOG, for now. Hence its low p/e may remain undeserving low, but balanced this with the impressive current high dividend yield and likely to growth, so make it an individual “investor jewel”. Realizing, when a stock eventually does rise, then so will provide far enhanced daily-trading liquidity. Trading volume most often soars when a stock eventually wakens up.

Again, I am likely missing something as there always is a risk of a new “black swan”; but as I write these that come to mind, I feel each individually none are very likely. But combined any of those might happen? The hope if it does, that TOG would not be overly affected and will keep up paying a solid dividend (as it has for many years), well beyond cash held in the bank here. Again, its products are semi-defensive, meaning not overly sensitive to broad economic changes. TOG stock is under-owned and under-analyzed and among the highest dividend payer here, so not likely to tumble on any speculative downdraft!

Here are some comments based on a conversation I just had with mgt:

1) During their latest SET-Opp.day event in the third quarter of 2022, TOG’s CEO imparted vital details about their 2023 new investment plan, which amounts to 800 million Baht. This allocation is split into two primary segments: THB 500 million for the RX Automation line and THB 300 million for the Casting line, with the investment being supported through long-term Bank loans. So no share dillution.

2) The solar rooftop project has already been successfully completed in accordance with the original plan. Stating, "TOG will provide updates on the realized savings in the near future".

I note from reading in detail their last annual report, TOG electric bill averages around 40 mill. Baht per year, I would guesstimate this will drop in half, post their Solar rooftop project already operating. As most of their electricity demand is during the day, when the sun often shines here. Hence, 20 mill. Baht savings, which is 5% of its last full year earnings, or so increasing its NPM nicely for part this -and all of next year! Last year TOG's NPM was 16.5% so now could go above 20%? Remember expanding Rx lenses next year command higher profit margins.

3) I noticed digging into TOG financial statements a THB 17.9 million bad debt which can be attributed to a customer's bankruptcy during the COVID pandemic. The company states on this it: “exerts diligent efforts to reclaim outstanding debts, it's important to recognize that such situations are a natural part of our everyday business operations, particularly given the challenges brought on by the pandemic. However, it's reassuring to note that the THB 17.9 million represents a relatively small fraction of our total sales and profit, constituting approximately 0.6% and 3%, respectively. Therefore, there is no cause for significant concern regarding this figure.”

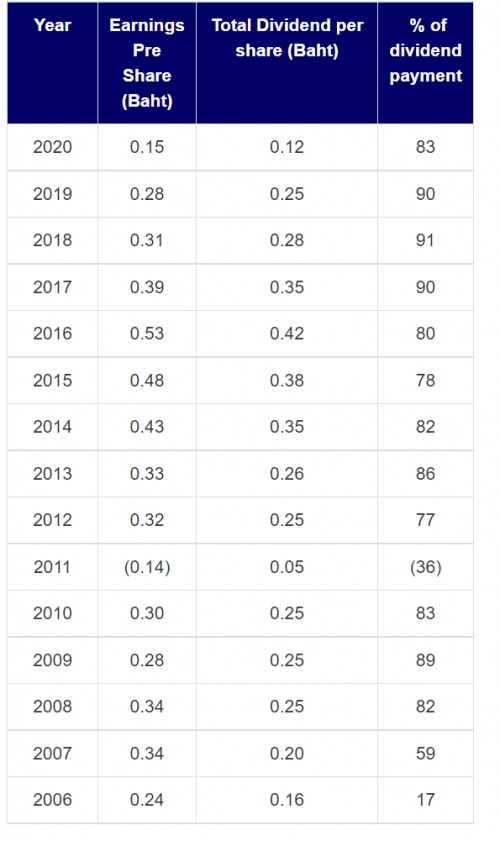

Take a look again at their (see table) a long dividend history, going back to 2006, noting h0w TOG long dividend payout is well above their stated 40% of net profit, or averaging over the past 15 years close to 80%! :)

We find that a solid long history on regular high dividends is commendable and noteworthy -and adds shareholder value over time. Last year 2022, we note the payout (dividends) was high again at 74% of TOG’s net profit, at 0.63 Baht per share vs. 0.85 Baht per share in EPS. As the insiders own almost 50% of the outstanding shares and since in Thailand there are only one class for common shares allowed, its noteworthy how the insiders and all of shareholders much benefit equally from high dividend payments and not least, from so long-term new shareholder value generation. Vs. a company were the insider get high salaries, but own few of the shares and pay low dividends, like so many all around.

The other thing which just seems to get too little global attention is this emerging "Myopia generation" reality. Previously mentioned in my last article. This is a significant children phenomena all around the world -affecting young & mid age children, yes globally.

My Original article of TOG, Submitted by PaulRen on Sun, 09/07/2006 - 8:32am

https://thaistocks.com/content/visit-thai-optical-group-plc

Year 2024 looks like product expansion at higher profit margins, with no share dilution. I remain a strong longer term investor fan of TOG (12) for all the reasons here stated -and then some.

Best Regards,

Paul A. Renaud. www.thaistocks.com