TOG (12) Thai Optical Group bullish. Here is my comprehensive report on why.

Year 2024 looks like product expansion for TOG, at higher profit margins, yet with no share dilution. Benefiting from Baht weakness.

We listened carefully to the SET Oppt. Day, TOG presentation on September 1. Duly noting how unlike many other listed companies, TOG has given regular such shareholder presentations for many years -and then takes the effort to upload these to YouTube. Alas, they are only in Thai language, but all the tables/graphs and more are in English. Here is my key article on TOG, and I show some of those/their tables. Originallyy I here much posivitely viewed TOG at 6 Baht back in April 2020, and remained bullish all along and more then any other selection here since. You can see TOG web site: www.thaiopticalgroup.com

Despite TOG’s stock price doubling to presently around 12 Baht (+ handsome dividends all along) over the past 3 years, I remain an investor-fan and view to keep accumulating TOG -while not yet nailing profits. This is a rare exception (as I usually view to take profits at 50% gains) to those members which have nice unrealized gains, as TOG keeps delivering earnings & high dividend, above expectations.

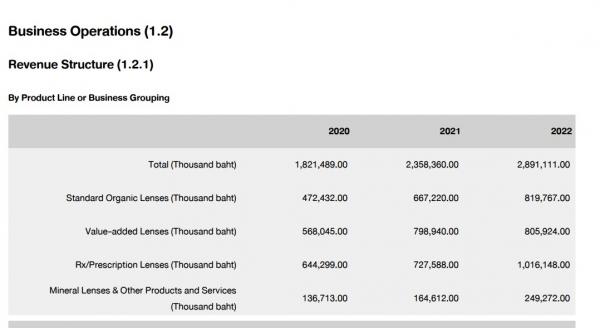

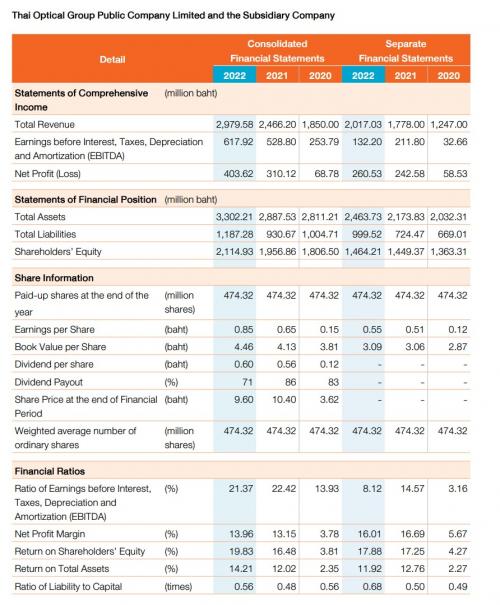

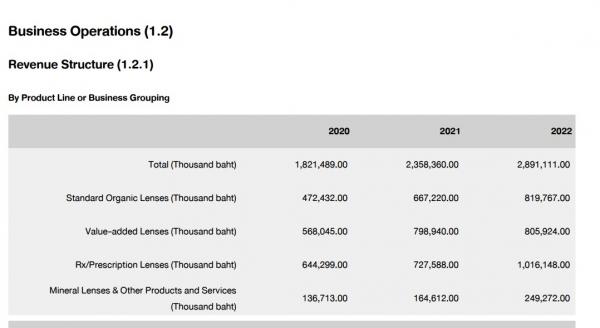

Again: while TOG stock price doubled since, its net profits have far more than tripled from net profit of 68 mill. in 2020, to 403 mill. last year -and 229 mill. for the first 6 months so far this year. I expect TOG to earn close to 450 mill. in year 2023 -or close to 1 Baht per share with continued high dividends all along. Then higher net profit next year approaching 500 mill, due to higher margin Rx product expansion already implemented and start generating new sales early next year. TOG benefits from a weaker Baht currency as 96% of revenues come from exports to some 50 different countries.

Its ROE roared up from 3.8% to 21.6% during this same period. Their 4th Q. is usually their seasonably strongest, while the 3 Q. their weakest. Any weakness in TOG share price below 12, is a strong buying opportunity in my view.

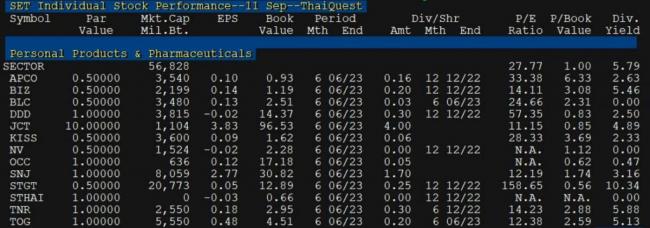

It’s trailing p/e is 12.8 as of September 12th, vs. 17 for the SET, while its dividend yield remains one of the highest of any here at 5-6% (near double the SET average shown at 2.99%) -and its growth rate should keep up next year as by then TOG comes on stream with 30% more production capacity on its higher profit margin Rx lenses! As noted below.

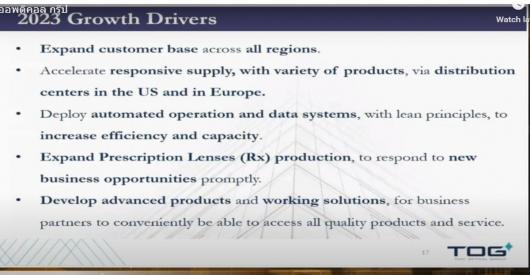

This so, post planning investing up to 800 mill. Baht into this new enhanced and in demand existing product line. TOG already to-date invested 500 mill. -and now is in the testing phase. We can see this affirmed looking closely at their latest financial statements: Property, plant and equipment increased to 1,551,550 now from 1,010,510 Baht, shown at the beginning of this year. As per line 26 of their financial statement. And On Line 46 there, we see short term bank loans increased from 635 mill. to 1,061 mill. Baht, all as per June 30 2023. In their P/L financial statements we can also see how finance cost rose from 3.9 mill. to 9 mill during this same six month period, comparing Dec. 31, to June 30. This so confirms substantial new investments have been made yet omitted by the DAOL analyst in her report (see below).

We can also see this same in "Property, plant and equipment" increase in #8 in their notes to financial statements”, well as again #9 regarding Short-term loans from banks which nearly doubled to 1,061,417 Baht, as of June 30 vs. 635,000 shown as of 31 December 2022.

And here is a statement on this taken from page 23 of TOG’s latest annual report:

“Expanding Prescription Lenses (Rx) production, to respond effectively to new business opportunities The Board’s resolution on 10th August 2022 approved an investment in the Subsidiary in Thailand, Thai Optical Company Limited (TOC), to renovate a production area, by equipping it with advanced automated production systems for manufacturing Prescription Lenses (Rx), to quickly respond to business opportunities and support growth. This includes applying an information and digital technology system, to manage the end-to-end manufacturing process, and an inventory work system, in accordance with the international standard of medical device manufacturing qualification system, ISO13485, and the environmental standard, ISO14001, as well as the utilization of renewable energy, to minimize environmental impact.”

Rx prescription lenses/production increase is what will drive growth next year and beyond, while keeping up high net profit margins high or Baht weakness vs. US$. Net profits margins (NPM) have nicely roared up over the past 3 years from: 12.82% to 13.63% to now 16.54% for the first six months this year.

Nothing was re-mentioned in their presentation Sept.1 on how they will finance this expansion. We so assume it’s from cash-flow and bank borrowings, no share dilution, but this was just re-confirmed by the company. As I recall this (bank loans) was mentioned a year ago, and as mentioned we see this well confirmed in their financial statements on increase interest expense. I am convinced mgt. would have disclosed if it was different -or this now had changed. In fact it has not and the analyst should have mentioned it.

“The Board’s resolution on 10th August 2022 approved an investment in the Subsidiary in Thailand, Thai Optical Company Limited (TOC), to renovate a production area, by equipping it with advanced automated production systems for manufacturing Prescription Lenses (Rx), to quickly respond to business opportunities and support growth.” TOG official SET announcement from last August 10 2022. See here: https://weblink.set.or.th/dat/news/202208/22093070.pdf

TOG so remains a great investor choice in a semi-defensive product line/industry, with 96% of revenues exporting to over 50 countries to 6 different continents, worldwide (hence not dependent at all on maxed-out Thai consumers) -and besides a triple beneficiary of demographics:

1) baby-boomers aging and this all over the world, as well as 2) “myopia generation”, where vast amount of young children increasingly need corrective glasses. And not least, 3) billions of people spending more and more hours on-line every day, which almost always over time requires vision correction or protection. Younger people, pre teenagers, around all over the world are wearing more and more corrective glasses -but this new & increasing sad reality is rarely reported/acknowledged:Please do re-visit this member article on this “myopia generation”, from exactly a year ago: https://thaistocks.com/content/remain-super-investor-bullish-tog-960-mid-long-term

TOG in year 2022 showed 96% of total revenue came from exports, up from 93.5% in calendar 2021. International sales to 50 different countries are key in driving the growth of TOG’s quality lens products. Approximately 98% of the raw materials, which are specific to the optical industry, need to be procured from overseas. In the presentation they mention raw materials costs are “stable”. While TOG has currency hedges in place, it does clearly benefit from any weakening of the Thai Baht currency in general.

Their distribution centers, operated by third-party warehouses in the US and Poland, serve as market channels, on such as independent prescription lens manufacturers, retail networks with in-house prescription lens manufacturing, cutting and mounting facilities, and retail/buying group networks. These centers closely support business customers in various broad different geographical locations, enhancing so more timely deliveries, serving seasonal demands in varying markets, all with a variety of readily available products. This is a key attribute as often if their lens products are not readily available, bulk purchasers then tend to go elsewhere.

TOG is a 60+ year old reputable long-established Thai company globally competitive in a growth/semi-defensive industry which now in addition benefits from Baht weakens due tame Thai economic recovery -as TOG is well removed from all of that, including Thai politics. As well, if China further regresses, as it now appears many company globally are distancing from there.

Its stock price may be tame a bit around 12 now so to consolidate for a while (?), post a 35% rise in the 2Q. even while the SET was bearish then as now. Its 3Q. financial report will include a 8.5 mill. Baht loss realized from an already divested subsidiary in Singapore. Hardly worth mentioning for a company which now earns over 400+ mill Baht a year. See here from their notes in their latest financial statements, page 20: “Disposal of investments in associate. On 9 August 2023, the meeting of the Company’s Board of Directors pass a resolution approving to dispose the investment in M Vision Optical Pte. Ltd. (Incorporated in Singapore) with amount of SGD 0.33 million or approximately Baht 8.57 million.”

Traditionally, TOG 4th Q. is its best seasonally for TOG products. Next year looks like growth will resume, again due to its new Rx product expansion, as explained above. A key driver to my bullish view, along with its low trailing p/e of 12 and dividend yield likely above 5.5%.

As of end of January the Pracharktam Family is by far the largest shareholder owning some 49% of total outstanding shares. I counted a total of around 20 different persons with this same last name being various big and small shareholders in TOG, from 0.14% all the way to the largest being at Mr. Torn Pracharktam at 5.5%, holding 26,144,800 shares. This is positive as they have allot at stake in generating shareholder value -besides high dividends which TOG has a solid long term record on that.

There are no recent insider selling or buying reported by the Thai SEC. Here is the link: https://market.sec.or.th/public/idisc/en/r59

As of January 18, 2023 there were 33.63% of the total shares of the Company held by foreign shareholders. There are no treasury shares/stock listed, or held. (Treasury shares are shares bought back in the open market, by a listed company).

TOG has 474.318 mill. total shares outstanding. Hence its total mkt. cap is 160 mill.US$, at the current exchange rate. Relatively small for most (but not all) institutions, but surely no micro cap! The shares trade fairly regularly at several hundred thousands every day, with the average daily trading in August around 450,000, but more lately.

TOG is listed under ‘Personal Consumer Products’, where the average p/e is 27 for that sector! TOG at p/e 12 is the 3nd lowest in the sector (see below). TOG manufactures spectacle lenses, i.e. class 1, non-invasive, medical devices, designed to correct refractive errors, causing impaired vision. TOG offers a wide variety of lens materials and designs, to treat near- and far-sightedness, astigmatism, and presbyopia, as well as to enhance functional requirements, such as aesthetics and comfort with thinner, lighter, or photochromic lenses, UV or blue light protection, and additional processing, including anti-scratch, anti-reflection, hydrophobic and anti-glare coatings, or color tinting. In certain cases, some business clients also require lenses for additional processing and/or customization, for example with dual intended purposes, personal protective equipment, or patient-matched vision correction.

TOG auditor, does not mention anything of concern:

“Conclusion

Based on my review, nothing has come to my attention that causes me to believe that the accompanying interim financial information is not prepared, in all material respects, in accordance with Thai Accounting Standard 34 Interim Financial Reporting.

Sarinda Hirunprasurtwutti

Certified Public Accountant (Thailand) No. 4799

EY Office Limited

Bangkok: 9 August 2023”

From its comprehensive 2022 212 pages annual report:

“In 2022, the Company invested in production capacity expansion, with automation as the key driver. For the next round of developments, TOG has planned for the replacement of mature manufacturing lines with automation and is prepared to systematically invest in the increased implementation of planning, tracking, monitoring, and controls. By 2027, the Company intends to transform 90% of prescription lens manufacturing processes and over 50% of mass lens manufacturing processes, with the deployment of automation and digitalization. “

“To achieve this operational transformation, the Company will heavily invest time and effort in its human capital and training programs, to ensure TOG acquires and retains all of the necessary capabilities and expertise, in the relevant, required technological fields. The Company already cooperates with educational institutions, on research and development projects, and offers opportunities for student internships and continuing work programs. All of these initiatives aim to accelerate manufacturing innovation and fulfill the Company’s targets.”

“MISSION To become a leading, sustainable, independent manufacturer with a global reputation for consistent service excellence, ease of doing business and supplying the best value stock lenses and complete Rx service solutions on time every time.”

“With impressive, recent operating results, we are on track to unleashing our full performance potential, as we serve our existing customers, and expand our customer base, across all regions. We are committed to consistent service excellence, and best value spectacle lens products, as we strive to earn the trust of our business partners and customers, building a streamlined and efficient supply chain, as a reliable, sustainable lens manufacturer of high-quality lens products”.

Quote from Dr. Sawang Pracharktam) Chairman of TOG.

Searching in their comprehensive latest annual report for key words like “litigation” or “employee disputes”, I found nothing came up.

Competition:

The three global players, with significant influence on the global market, are as follows: 1. EssilorLuxottica S.A., a French-Italian multinational company, resulting from the 2018 merger of the Italian Luxottica Group S.p.A and the French Essilor International S.A., designs, manufactures and distributes ophthalmic lenses, optical equipment, eyewear and sunglasses. 2. Hoya Vision Care Company, a subsidiary of Hoya Corporation, is a Japanese company, engaged in manufacturing, designing, and distributing optical products for healthcare, medical, electronics and imaging applications. 3. Carl Zeiss Vision International GmbH, a subsidiary of Carl Zeiss AG, is a German company, engaged in manufacturing, designing, and distributing ophthalmic lenses and ophthalmic instruments.

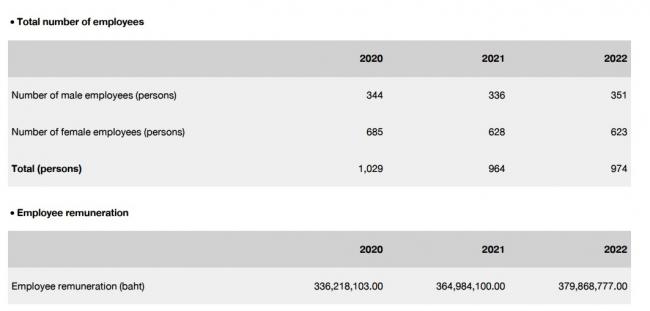

Employee training expenses are soaring, see here below. We know why.... more than tripling since 2020 and doubling from 2021:

Last but not least: Here is an interesting twist, I want to mention last but not least, as it rises some eyebrows:

To my knowledge up until now only one Thai brokerage firm (DAOL Securities) follows and writes research in Thai language only on TOG. It has, I dare to call it, a lame duck “hold” rating (same as months ago) which was just re-affirmed in its latest report, published on August 10. 2023. The analyst’s name given is: Mrs. Veeraya Mukdapitak. What is surprising, by its clear omission, in its report that it barely mentions about TOG already in progress 800 mill. Baht expansion plans. Why? As a long investor pro. here, I find this short of odd as this is major news, already happening in full now and SET reported over a year ago -in fact the key growth driver for next year and beyond, not least at stated higher then current net profit margins.

I wrote on Aug. 11 to K. Veeraya: “…you mention nothing in your latest stock report on TOG regarding their announced planned expansion? An ineptness in my professional view I dare to point out.” A 2 months later no answer back received. :) Its also a bit amazing how this analyst shows in this same report, dated August 10th 2023, expected net profit for 2024 at 447 mill., barely increasing from her 2023 estimate of 444 mill. Despite we already know their new RX product expansion, and at higher profit margins happening.

Could it be that some smaller cap. fund is accumulating this stock and so did not want this to be mentioned? A cynic so, would ask. I am just observing -not accusing.

The other interesting thing around this is how on October 11 2021, this same analyst wrote in a TOG report back then with a target price of 13.50 Baht (but now reduced to 13), when this analyst estimated back then TOG to earn net profit of 310 mill for all of 2022. Well, she was 30% off the mark, yet now reduced her target price (!), as we see TOG earned 403 mill. last year. Profits have soared well beyond (her) expectation back then, + the company now has solid expansion plans already ½ implemented with no share dilution (not mention) and yet her price target reduced to 13. Go figure. To restate: DAOL does show a TOG profit estimate for this year 2023 at 444 mill., or 0.94 Baht per share, and 447 mill. for 2024. TOG's EPS for 2022 was 0.85 Baht increasing from 0.65 the year before. I remain a strong longer term investor fan of TOG (12) for all the reasons here stated and then some.

Best Regards,

Paul A. Renaud. www.thaistocks.com TOG, among the lowest p/e of the sector while growing faster:

Here are some more company details: Thai Optical Group Public Company Limited Type of Business: Manufacture and sales of ophthalmic lenses Head Office Thai Optical Group Public Company Limited 15/5 Moo 6, Bangbuathong-Suphanburi Road, Laharn, Bangbuathong, Nonthaburi 11110 Thailand Telephone +66 (0) 2 194 1145 to 50 Facsimile +66 (0) 194 1151 Investor Relations: Telephone +66 (0) 63 903 0780 Email ir@thaiopticalgroup.com Website: www.thaiopticalgroup.com Registration No. 0107547000044 Ticker Symbol: TOG Listed on the Stock Exchange of Thailand since May 16, 2006 Registered Capital THB 475,000,000 (475,000,000 shares) Par value THB 1.00 per share.