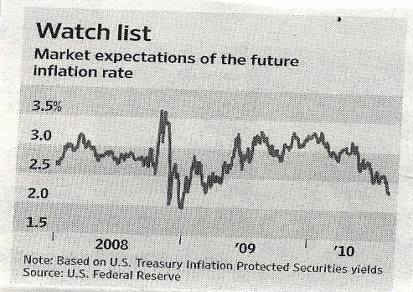

Where is the inflation they keep warning us about?

Where is the inflation so many have warned us about? (Marc Faber & Jim Rogers company and others). I could post many graphs here showing in fact price declines over some time, not just recently. Market expectation of the future inflation rate in the US, now shows a decline in inflationary expectation.

As I wrote here sensing this trend already 3-4 years ago.…and its not clear how 2011 would/will suddenly see a meaningful pick-up in inflation? The US government stimulus perhaps just replaced the trillion $ meltdown of capital lost due to the financial crisis?

Here you can see my original article clicking on this link: http

A year ago, before and after, we heard again and yet again how inflation would be coming roaming back -post all that government stimulus. To date just the opposite happened. Neither have oil prices -and the value of gold is not keeping up with equities which have had nice runs this year. Especially in Thailand.

The currently firm Thai Baht currency will keep inflation well at bay here, all other things being equal. Its becoming more obvious that overall price stability has been the reality well into 2010

Sooner or later the commodity bulls will have their turn again but of late and for now they are hibernating with their alarmist scenarios -and stocks are likely to keep performing better here even in a benign global environment. Nothing is a better mix of high Thai dividend yields along with continued low inflation besides the level of general interest rates.

Best Regards,

Paul A. Renaud.