What the Social Responsible investors don"t seem to consider.

What the Social Responsible investors don"t seem to consider. More on distorting local markets through excess capital allocation to large cap stocks.

Subj: Good to meet you/feedback./SRI, a comment.

Date: 8/17/02

To: ROBERT_JAMIESON@set.or.th ESP specialistMR. ROBERT JAMIESON

I met Mr. Jamieseon totally by coincidence last week in Bangkok, when we had an early coffee together He is one of the very few foreigners whom works for the SET. After our discussion and him mentioning AsrIA (see the end of this article), I got motivated writing him the following letter, here now shared with all ts.com visitors:

Dear Robert,

Nice to meet you the other morning!

Thanks for your thoughts on this Far Eastern Economic Review article. As I told you, too bad they never write more on what is working well here investment wise -and for so long already. Instead these magazines dwell too much on what is not. In my view a business magazine should tell about success stories as well as things to be concerned with. These glossy magazines are so not balanced. Many of their readers are investors whom want to hear what is working, so perhaps to draw new investment ideas!

Post US & European stock sell off, realize that smaller Thai cap value shares are now, by far, the best performing equity asset class in the World and this for some time. Whom is reporting on this?

Post US & European stock sell off, realize that smaller Thai cap value shares are now, by far, the best performing equity asset class in the World and this for some time. Whom is reporting on this?

On the matter regarding Thai government deficit spending, if not now then when? Consider also that tax receipts in Thailand are well ahead on previous projections, so temporary deficit spending may not be at all such an ill-road out of a crisis. And it seems to be working --as the local economy is on the mend. Years ago this worked well for USA.

***

Regarding "social responsible investing and corporate responsibility ": the leaders on this theme better start asking more on why so much capital remains in corporate America which is full of scandals and grotesquely high, executive compensation. On top of this, mostly overvalued US stocks with little near term growth prospects. Besides all the accounting scandals, why is there such portfolio overweighing there? This is in itself socially-irresponsible.

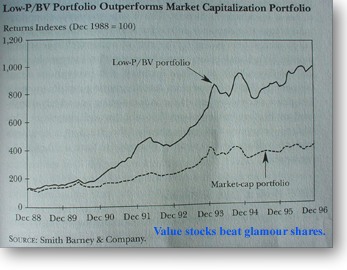

SRI (Social Responsible Investors) also deserves blame & heat by investing into emerging countries and then only considering mega stocks, hardly the backbone. On this they should ask questions regarding their own corporate fund responsibility. The pervasive practice on distorting local markets through excess capital allocation to large cap stocks, which often, do not represent the true economy here at all. Call it social irresponsible misallocation of dire resources. The worst part is that their distortions not only contribute to eventual economic crisis like "97, but in addition miss out on incredible returns for their fund owners, as for the past 5 years already secondary shares on the SET have beaten the SET benchmark and this by a large margin. So I say, there just has to be a better way for the funds to be more responsible and more profitable!

There should be more social & corporate responsible questions posed to the very SRI’s, as they (as well as most other funds), heavily misallocate resources toward big size, rather then real economic value, besides more human contribution.

Lets face it, in Thailand, Western institutional funds have for over a decade mostly unintentionally avoided superb and responsible companies, simply and only so, because of their relative mkt cap. size. This has caused grave behavioral misallocation of resources.

What would the many investors in SRI’s say if they knew what I know on all this? For startes, these SRI’s should promote local equity research and hard work in finding and investing in these desirable firms. This is what I call responsible investing; rather then just routinely disqualify stocks by mkt cap size or polluters or poor corporate governance. No question, the long entrenched irresponsible habit of funds only considering largest size, is just as harmful as avoiding polluting & non compliant companies! I can write yet another essay on all this, but I think I have said & shown enough about this at thaistocks.com

The SET itself is a bit in "a dark hole" by not pointing out this poignant reality, so pervasive for years already. I do not mean by slamming the funds. The SET should state more on what is working wonders here, investment wise! Like was this reality stated at the fair "SET in the CITY"? In my view, Khun Taksin targeting individual investors is a smart move. As many then invest by proper valuation and business prospects, not just "size is all mighty God". Global individual investors certainly have allot more information at hand then in the past. Of course many people just speculate -but this is changing now as more serious long term savings" money (the big money) has gotten the message: high dividends and low stock p/e’s, not large cap Thai shares, are overall the long proven performance stars.

If the SET showed a performance tabulation solely based on market cap. here, over the past say 1 year, or 2 years, or 3 years, or even 5 years....all the same, you would quickly see again and again, how the smaller tier shares have for years already mostly beaten all other sectors on the local exchange. And despite this, this smaller cap sector remains the most undervalued along with highest annual dividends. All too rarely praised by professionals. Perhaps it is to their advantage to point this out?

From what I know, the SRI’s have not even addressed the above grave and market ill-twisting distorting dire reality. Until they do, I am not a big fan as they only address half the problem. Of course, I welcome any comments and constructive critique and will publish it here if of valid interest.

Best Regards,

Paul Renaud

PS. A member comment -just received showing another current reality:

"I"ve spent about two weeks recently looking at a U.S. company, McDermott International. The hedge fund I used to do some work for has followed this company closely for several years, and I bought some shares, primarily on their recommendation, without doing my homework. Anyway, when the price dropped recently to P/E of 3 to 4 (2003 & 2004 earnings), I decided to take a closer look.

"I could literally spend 6 months looking at this company, and then not understand it as well as a typical Thai small cap. There are impairments of PP&E, writedowns of Goodwill, acquisitions, divestitures of subsidiaries, and on and on. So, here’s another reason to add to the list of why I prefer Asian small caps -- they"re easier to understand."

***

What is SRI, for some answer read their own defintion.:

http://www.asria.org/asria/intro

The Association for Sustainable & Responsible Investment in Asia

ASrIA is a not for profit, membership association dedicated to promoting corporate responsibility and sustainable investment practice in the Asia Pacific region. As an association, ASrIA acts for and on behalf of its members. To achieve its mission, ASrIA aims to be primarily a web-based resource, supporting partnership initiatives on the ground throughout the region.

Our Programme

Our Programme

ASrIA is dedicated to providing insightful, up to date and accessible information on the development of SRI in Asia and globally. Through fostering the creation of SRI products and services, and through the provision of training and support services we aim to build momentum for SRI in the region and to raise the standards of SRI practice.