US stock over bulls. Africa emerging. China beating in performance.

Lots of Western money managers remain still US stock bulls. As I can’t help to notice all kinds of “buy the correction” comments or “be patient it will come back etc”. The with bravado acclaim their past US stock returns, as if it was a given the future will be like the past. Comparing the future to the past often a a big mistake as the World is changing faster then ever.

If you take the longer term view: I for one think longer term Africa is now emerging post decades of staleness. All the while starting to protest against USA Govt. with its long infringing attitude, along with select EU countries. Africa is embracing China more and more on its more “live and let live” disposition. Realize, by 2050, 1 in 4 people in the world will live in Africa. The fastest growing and now evolving along with the youngest population -while the most optimistic about it's future!

Here is how one answered me in a discussion lounge full of money managers:

“The problem with Africa is the lack of condoms. Whilst the birth rate is higher than Europe, so is HIV and most forms of VD. The Roman Catholic Church is largely to blame for that. The other problem is that the world needs to reduce its population by 50% long term, so the birth rate in Africa could do to come down. Then you have the problem of a lot of young African men migrating to Europe rather than making their own countries better.”

My short answer back was as such: ok true no doubt, even while this is changing for the better. But/yet it’s all about marginal differences is it not, as all continents/countries have their own thorny albeit very different issues, right? In most of the EU I read close to 1/3 of all tax money goes to entitlements, often abused; then there are so many old people there which now live ever longer while not economically productive. Now, Germany wants to spend 5% of GDP on defensive (crazy) all on account of Russiaphobia.... ,but more likely to grease-up the hands of their defensive industry vast beneficiaries...., which has no real economic multiplier effect. All the while still -on most core issues- just blindly following the US Govt. in its own delusions regarding Washington still believing it’s a global hegemon….and its Neocons which, surprise, President Trump himself criticized this week, in a key not address in Saudi Arabia.

***

Just to share to reflect here post all the Thai stock continued bearishness and poor on going SET investment performance. As you remember, last Feb. 2024, I turned broadly China stocks bullish for the first time in a long, long time -ha longer than I can remember. And stated so clearly at my web site for members. You can see the link here China Bullish https://thaistocks.com/content/start-accumulate-china-select-etfs-stock-...

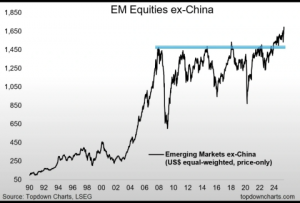

My favored China diversified mgt. fund, called BCACTEC:TB mentioned back then was at 3.28 Thai per NAV unit, in February 2024, and just is now at 4.64 Baht, or up 41.4% + 8.5% Thai Baht vs. US$ currency appreciation. Or a total appreciation of just about +50% in US$ -or way, way beating US broad stocks, by any measure. No matter what a Western money managers say, China stocks of late have been better performer and by this measure the true stellar performer! Sorry for the repeat, but also mentioned XIAOMI as an individual big cap stock pick there which one can buy on the SET here as a DR (XIAOMI80), back in June 2024, was at 7.75, now 21.80. The BCAC fund performance is noteworthy as it includes a small front end fee -and is diversified so represents a broad China basket.

Back then viewed to start out with a smaller lump sum then and to regularly "dollar cost averaging, DOC," every month since. If you did that, as of May 13th this fund is up 18.5% in Thai Baht currency + the Thai Baht increased some 8.5% over the same period, so in US$ terms up close to 27%. But remember this under-tallies as it assumed only a regular monthly investment -over the past 14 months.

So good money managers in the West which claim they smartly avoided all but US stocks, and keep up their bravado should reflect some into the future.

Paul A. Renaud. Beyond Thaistocks.com