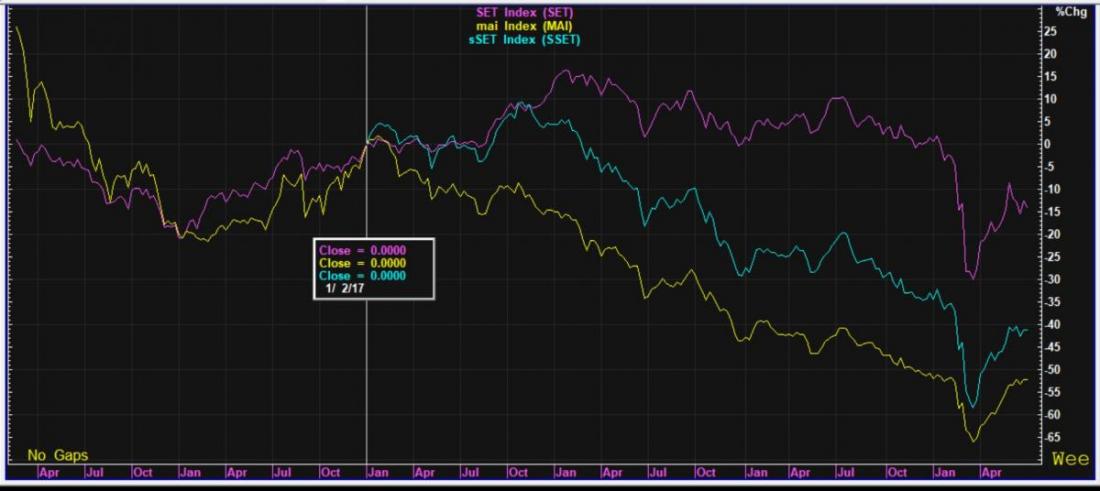

Updated graph on SET vs. MAI and sSET indexes.

Updated graph on SET, vs. MAI and sSET indexes showing the divergence, yet bouncing back of late.

Here below is an updated graph showing the SET vs. MAI and sSET indexes, the latter being a good representation of the smaller cap Thai stocks which is a sector I here always stated was the investor mandate but I changed some of late with big cap stock picks like BBL and PTTGC, both of which did well in my last model portfolio. Note how starting around early 2017 the two started to diverged considerably and this only increased over the following 2 1/2 years. Also to note: is how before 2017 the graph shows these indexed moved pretty much in tandem...note on the right side, how large this divergence truly is. Since the start of 2017 the SET index shows a 15% drop vs. just about 50% drop for the Mai and sSET! The extend and the length of this divergence was never seen before in my 30 years following here. But, we can see the rebound in Thai stocks, post the nadir low point in March 2020, was equally strong in smaller cap stocks. In my last model, ending early June 2020, some of my smaller cap stock picks did better then the big cap ones. Its yet to be seen if things have finally bottomed for this sector. Retail investor participation has increased of late.

This abnormality has never been pointed out by brokers, the biz press, Bloomberg or any others (than me) to my knowledge. Please correct me if I am wrong.

Why? The other other Why? is why has this happened to such a dramatic event for so long? While I don't have the answer to the first Why, I am pretty sure we know the answer to the second Why, which is: smaller cap stocks are often mostly avoided by institutions and traders due to relatively lower trading volume. In the long and up until 2017 past, individual investors made up by rightly seeing value, higher growth besides good dividends in these. As here often pointed out, individual investor participation (as a % percent of market volume) has all but dwindled to around half compared to years past. This phenomena is in good part due the brokers' ill behavior which I have amply written about in the last 3 years. Brokers and its marketing officers have ever more so advocated trading/speculating which ah soo many studies have shown only in the longer term then burn investors, especially in a lethargic market, hence their exit. Investors whom get "churned and burned" then have a long memory and so half or more abandoned investing in stocks as a form of credible savings. Call it the failure of the Thai broker industry, which the Govt. since 2015 has shown little if any interest in addressing. Few outsiders to Economy/Finance understand how important the smaller and mid cap sector of the economy is, not least as they represent by far the majority of economic activity (GDP). Another tragic enhancement of wealth inequality taking place here -as is in many places around the world.

Best Regards,

Paul A. Renaud. www.thaistocks.com