TOG remains my solid investor choice for rational individual investors!

Date: August 15, 2024

TOG reports another solid Quarter along -with impressive top-line growth in total revenues.

Here below is a summary what I was able to fish out of TOG’s latest financial statements, as released to the SET on August 14 2024 -for their 2 Q. The big positive surprise is the +41% increase in TOG total revenues for the last Q. and +33% increase for first 6 months 2024 vs. same first 6 months period last year. Here are my notes from their financial released reporting and some as quoted by their mgt review, release:

“TOG and its subsidiaries generated total revenues 955 million Baht, which was an increased by 277 million Baht or 41% from previous year. In 1H/2024, TOG and its subsidiaries earned total revenues 1,844 million Baht, which was increased by 455 million Baht or 33% from the same period prior year.”

“In Q2/2024, the Company and its subsidiaries had net profit 119 million Baht which increased by 2 million Baht or 2%, from the previous year. In 1H/2024, the Company and its subsidiaries had net profit 231 million Baht which increased by 1 million Baht or 0.4% from prior year”.

Which derived from Rx/Prescription Lenses at 140 million Baht, Value-added Lenses at 73 million Baht, Standard Organic Lenses at 60 million Baht and Mineral Lenses/Other Products and Services 4 million Baht.

“In 1H/2024, Sales revenue increased in all regions with the Americas increased by 81 percent, Africa and the Middle East increased by 51 percent, Europe increased by 50 percent, Asia and Pacific increased by 26 percent and increased in Australia decreased by 12 percent. “ I find this most impressive as it shows strong top line growth, previously a bit of a concern.

“The proportion (expense) to revenue from sales and services increased from the previous year, mainly due to higher raw material prices and production overhead costs, as well as depreciation from replacement machinery and additional investment. In terms of selling and administrative expenses, the increase was mainly due to warehouse service expenses, import expenses, and travel expenses.”

I noted, for 6 months ending June 30 2024 vs. same period last year: Income taxes increased around 20 mill., Interest expenses increased by about 10 mill. Mostly due to new machinery investment. Depreciation increased by about 28 mill. Baht, or for a total of all of 58 million. One can see if adding these extraordinary-items back, TOG keeps recording record profits!

Higher depreciation and interest expense mostly have to do with TOG’s new Rx machine investment of late which yields is a higher profit margin product -and already reflected in their 2Q with its 41% increase in revenues. The company stated as well that it will further expand such machinery due to strong demand in the 4tth Q., or for an additional 30% increase in Rx capacity.

I think the soaring 81% increase in sales to the America’s is especially impressive as it’s a very competitive market there.

These extraordinary cost items is what contributed to a lower NPM and GPM which decreased from 26.5% a year ago to 24% for the last Q. Rx higher margin products now make up 44% of total sales vs. 39% in the same first six months period of last year -and is projected to increase to 48% for next year. I think this may be a low estimate due to planned additional 30% increase in capacity for Rx lenses planned by year end.

So called EBITDA, increased to 197 mill vs.163 mill in the same 2 Q last year, or +21%., and 28.3% Q. over Q. (from 154 mill.) Many analyst view this as a more meaningful number. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of profitability to net income. By excluding depreciation and amortization as well as taxes and debt payment costs, EBITDA attempts to represent the cash profit generated by a company's operations.

A main reasons for higher costs were reported higher raw material prices and production costs, as well as much higher depreciation from new machinery replacement and additional investment, all resulting in higher product costs compared to the previous year. As stated.

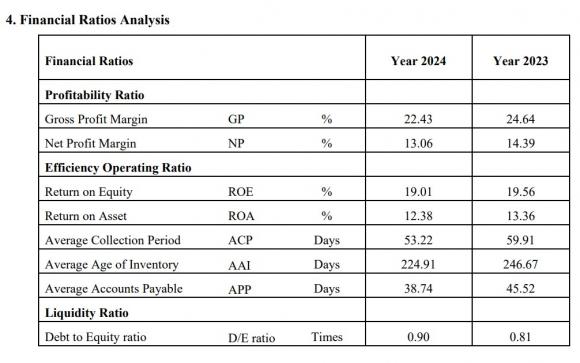

Also to note: Cash and cash equivalents increased by 154.18 million Baht. Long-term loans from banks - net of current portion decreased by 35.15 million Baht. TOG also shows an increase in new machinery this year of 229 mill. Vs. just 37 mill. for the previous year. Short term loans increased to 1,041 mill. Vs. 855 mill. as per year end 2023. And purchase of 35.6 mill of software vs. 0 for year before.  Here is the updated Financial Ratio Analysis, TOG just released.

Here is the updated Financial Ratio Analysis, TOG just released.

Selling and Administrative expenses in Q2/2024, the Company and its subsidiaries had selling and administrative expenses of 88 million Baht, a decrease from the previous year by 31 million Baht. In 1H/2024, the Company and its subsidiaries had selling and administrative expenses 168 million Baht, an increase from the prior year by 26 million Baht. The main reasons for the above increase are due to warehousing service expenses, import expenses and travel expenses.

“On 14 August 2024, the meeting of the Company’s Board of Directors pass a resolution approving the payment of the interim dividend for the operating results as from 1 January 2024 to 30 June 2024 of Baht 0.20 per share, totaling Baht 94.9 million. The Company will pay the dividend in September 2024.” Here are the details:

Record Date is 28 Aug 2024

Payment Date is 13 Sep 2024

Type is Cash Dividend

Same high dividend as last year, so the total dividend for this calendar year 2024, is 0.20 + 0.45 or 0.65 Baht, per share which comes to 6.5% yield based on TOG’s current stock price of 9.90.

Due to low current p/e valuation of 11, high dividend of 6.5% and likley increasing next year, mostly exports driven (94% of total revenues are exports so well removed from the lethargic Thai economy), and now in addition solid top-line growth due to established new investments in higher margin Rx lenses, and this is continuing hence: my view remains “solid buy” for longer term investment.

Paul A. Renaud. Beyond Thaistocks.com