A timely re-visit to one of our long favorites.

A timely re-visit on one of our long favorities.

A 100% capacity expansion plan bodes well for long term profitabiliy increases. President Rice (49) is a dire value, income and growth stock.

"President Rice (PR), 47 remains one of our top choice, "value small" cap. stock!" December 01 2000.

Here are some notes from a recent visit which only confirms our positive views.

Along with a few other favorites (regularly reviewed here) we still think this is the sort of place to be with some of your longer term investment funds. There will be those who will point out that PR's stock performance -for some time- has been stagnant. But these PR shares have held up and so preserved capital along a sinking SET benchmark. As Year 2000, is turning out to be a another severe disappointment here in Thailand, but most smaller cap. value shares have overall, performed satisfactorily.

PR, with a trailing p/e of just 3 -despite bright prospects- cannot but make us enthusiasts on PR. Hence we decided to get a fresh update from the company itself.

When we first started our coverage of PR in early 1997, at then price of 23, exports represented only about 25-30% of total revenues. This has increased to about 45% presently. Yet, management informs us that domestic consumption has shown some resurgence, just recently. A gradual (high single digit percent growth) recovery of domestic sales is now the actuality at PR.

In 1997, PR had planned for capacity expansion. This was then (rightfully so) delayed due to the correct perception that a crisis was looming. But now 3 years later, there are firm plans and actions at PR in proceeding with a massive capacity & productivity expansion set to be ready by mid-2002.

In 1997, PR had planned for capacity expansion. This was then (rightfully so) delayed due to the correct perception that a crisis was looming. But now 3 years later, there are firm plans and actions at PR in proceeding with a massive capacity & productivity expansion set to be ready by mid-2002.

PR plans to fully double it's basic core business, of "instant noodle" capacity, by the 3 Q. of year 2002. The company's management is working very hard and long on this largest capacity expansion ever undertaken by the firm.

The focus of the new plant will be on:

- 1. Efficiency, here much progress is expected in the new plant.

- 2. Hygiene, the company expects more and more large export orders and so is aiming at top modern, global hygiene standards.

- 3. Big expansion, the doubling of total capacity is a large undertaking by any firm and so requires good planning and implementation.

- 2. Hygiene, the company expects more and more large export orders and so is aiming at top modern, global hygiene standards.

The local domestic recovery in their core product along with some new product introductions nearly assures sales to increase close to double digit levels in year 2001. Domestic sales, as stated, are recovering now as this is a smart leading indicator that the Thai economy is not relapsing as some fear.

|

Also, consider comments just made November 30, by Mr. Somchai Sakulsurarat, president and chief executive of Thai Military Bank here. He said his bank has "seen increasing demand for commercial loans to expand depot space and for purchase of new machinery. The loan proposals indicate that manufacturers are building up inventory to serve growing". |

Regarding profit margins:

PR's cost seem contained as more of the packaging material is now locally sources. Pulp prices have increased some 30% recently -but are not expected to have a material effect.

Profitable subsidary:

President Bakery (51% owned by PR), completed their approximately 30% capacity expansion in August this year and so, is expected to re-contribute to earnings growth from here on. Up until the 3 Quarter of '00, PB was operating at full capacity hence no earnings growth came forth.

PB supplies much of the fresh white bread all around Bangkok and now upcountry as well. They also supply all buns and rolls to KFC and McDonnalds and other fast food outlets. Hence they possess leading insights on how fast food is growing in Thailand as well. (Another leading indicator).

When asked about loans to affiliate companies like President Agri Trading, the MD stated to me it is "not in their own interest to stretch this by any means and our firm goal is for all affiliate firms to have solid and or improving financial ratios".

Here is the questions most often raised by our subscriber or investors:

What about loans to affiliate companies? SPC group has a history of many such loans. My own view is that PR has a long record of non-abusive dealings in this and while the SPC Group (which PR 25% owned by SPC) has many shortcomings. But abusive and not-repaid loans etc..from listed companies, is not one of them.

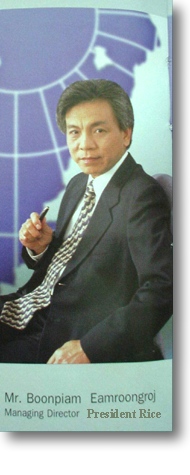

I remain very bullish on PR. Despite the good share performance over the past 3 years this stock is cheaper today then ever before. PR is a defensive company and a very successful exporter. I have visited management various times and have a good impression. We here could arrange a personal visit to PR, if need be. PR has an impressive & comprehensive annual report besides a long rising quarterly earnings track record.

I remain very bullish on PR. Despite the good share performance over the past 3 years this stock is cheaper today then ever before. PR is a defensive company and a very successful exporter. I have visited management various times and have a good impression. We here could arrange a personal visit to PR, if need be. PR has an impressive & comprehensive annual report besides a long rising quarterly earnings track record.

Best Regards to all our viewers,

Paul A. Renaud & Team.