The Thai retail investor's untold advantage.

Thai SET commands market inefficiencies!

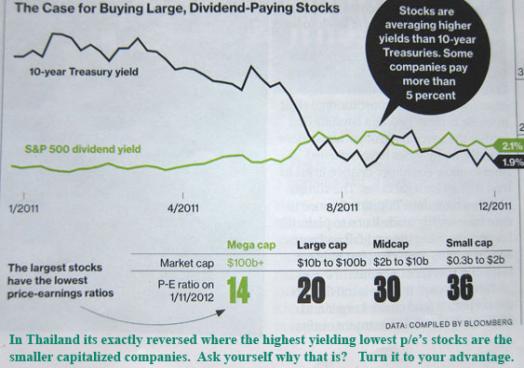

The below graph showing US market valuations reveal how differently Thai stocks are valued. Here large cap. stocks typically trade at two to three times the p/e ratio, this as compared to smaller cap stocks. Why?

While there may be some rational reason for this we see the overall immense market distortions on hand, which exceedingly prices liquidity over value. Individual investors can turn this to their big advantage especially so in the continued low interest rate environment.

Noted here many times before, the Thai SET commands market inefficiencies and these are indirectly nurtured by the behavior of brokers which refuse to reinvent themselves. With that I mean they tend to favor trading and institutional clients.

There are not enough rational medium term retail investors and this has languished for years. The day traders dominate and get the attention with the high commissions these trades generate. Marketing officers do not see themselves as new wealth creators, only transaction driven. As an old Wall Street saying goes, "where are the customers ‘s yachts?"

From the graph/picture below you see how there are immense valuation differences between US and Thai stocks. This has emerged due Thai brokers, speculators, and institutional liquidity constrained investors’ bias and so behavior. Stock valuations here, as compared to a developed market like in the US, are tipped right on its head . Is anybody else curious about this? Here is a case for likely continued superior returns, over time, due to such market inefficiencies. Further enhanced by prevailing low interest rates here, as well as around the world. Investors rightly demand, income, income, income -and the smaller cap’s in Thailand deliver on that and then some.

Best Regards,

Paul A. Renaud.