The Thai Banks did it again.

The Banks did it again.

Since early 1997 I have strongly advocated to just avoid all the Thai Bank stocks. I wrote, pounded the table and said so live on CNBC TV more than once. Over the years since, shares in this sector disappointed again and again. Yet the brokers for the most part keep advocating an overweight position, for years now. On May 1 '04, for the first time, I started a large cap model portfolio of mostly bank shares, but not KTB. (See below). While I am sticking with it for now, I almost wish I would have stayed away, as I have since 1997. (You can see this original article at the below link -but note there have been some portfolio changes since then, however not on the bank selections):

index.php?module=Pagesetter&func=viewpub&tid=1&pid=528

The latest "Bank stock panic sell-off" is just a recent example and there have been many over the past 7 years.

We monitor broker research carefully and noticed that lately more and more reports came in advocating bank shares. Then, late last week, the "bomb dropped" when KTB had to (as was reported) re-classify some loans, thereby creating a mini panic about NPL classification integrity in the whole sector. Since then, the SET lost another 4% and it was clearly bank shares which pulled it lower. The latest attempt of a SET recovery, once again, was heavily influenced and dragged down by the events in the banking sector.

Surely the renewed outbreak of chicken flu in some 15 provinces had some negative pull as well, but from where I watched events it was the banks that did the most market sentiment damage.

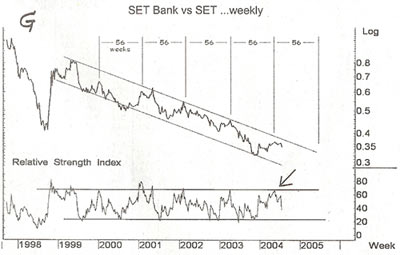

The enclosed picture is a graph on relative performance, which shows that for many years, this sector has been underperforming. In fact, this graph does not do full justice -as it compares the SET index to the Thai Bank index. Failing to note that the SET benchmark index, is heavily influenced by the Thai banks. The bank shares make-up among the largest segment of the index and usually more shares trade in this sector than any other. (Last year the bank and energy sector made up over 36% of the SET index.)

The truly revealing graph should show the SET-ex the banks, compared to the banking index. No such comparisons have ever been shown to my knowledge. Amazing SET!

I recently asked the SET president on "Radio Thailand" why don’t we have an alternative index to the SET benchmark index? As such a more realistic (and so fair) benchmark would have shown that Thai stocks recovered long before just last year, when the SET index finally moved-up. My understanding of their answer was that this was being studied.

A few years ago I knew a person who worked for the stock research department for a major foreign Bank. A big bank out of Hong Kong….I think you all know which one. Back then they had a whole floor of analysts, dozens of them I think, who did nothing but solely publish mostly upbeat research on only, yes you guessed, Bank stocks.

By far, some of the highest paid analysts here are the seasoned Bank analysts…and no sector is more analyzed, over analyzed (or money spent on analyzing) than the bank sector.

Classy road shows are sponsored and paid for by banks and the brokers -revealing their grand restructured operations and then distributing the various fancy, often inch thick, broker analysis reports.

The one part they leave out is how this sector has underperformed again and again and that Thai Banks do not represent necessarily what Thailand is best at. All composite SET data I have seen always included the heavy influenced Bank stocks, so when comparing Bank sector averages to SET averages, it is biased from the start.

In February this year I met with the head of institutional broking for one of the country's top brokerage firm. He was of course widely Bank sector bullish. Some of the country's top Bank analyistd are and remain wildly bullish. No bank analyst that I have seen or heard of is ever negative on this sector.

It is appalling that Bank stocks, again and again, get so very highly promoted to new and old investors. And while institutional investors can hardly ignore them, due to their gigantic demand for share liquidity, individual investors are regularly bombarded as well. Yet, Bank shares on average pay less than half the dividends and trade at a higher p/e than the SET averages.

The relentless broker poundings on Bank shares is done with all their fancy research reports with tables and lengthy analysis. The reports are often prepared by CFA's. Yet, time and time and again (and one more time), they have disappointed investors with below average performance, as the graph below shows.*

I started a model large cap portfolio on May 1 '04 so to give some needed balanced views on large vs. medium and smaller shares as well. As I now believe that Bank stocks are bound to catch-up some, at some point. Will I be the last to cave into the Bank share trap?

That, "some point", keeps being pushed back in time and the recent events in the ever volatile Bank sector, shows me again that they remain hardly the blue chips the various upbeat broker reports make them out to be.

Best Regards,

Paul A. Renaud.

* This graph was published in the Bangkok Post, Business Section on July 26 on page 7.

By Khun Anant Tantuvanich, Tisco.