Summary on today's TOG SET Oppt. day presentation.

We just listened to the last Quarterly TOG presentation with much interest, as given at the SET Oppt. Day live Presentation given by MD & finance and accounting staff, on December 22 2023, at 13:15 PM. Based on listening carefully to the entire presentation, Strong buy view re-affirmed today. Below is why:

The main points:

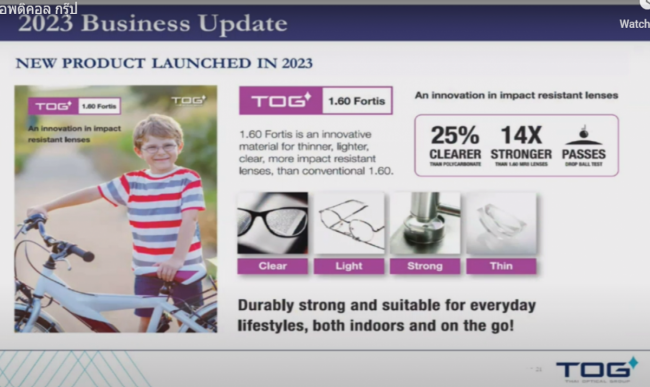

Rx lenses, a higher margin lens product are selling very strongly, beyond expectation, to the point of TOG accelerating their previous expansion plans and even considering expanding with new factory in SE Asia. The testing period on this was short-cuted to meet present very strong customer demand.

Demand from Australia is very strong and “doing very well”, perhaps due to end of year seasonable demand. EU is on-going, India upcoming and new customers coming in. Interest is in India and Afria as well as S. America. TOG very strongly focused on high quality and exports to 50 countries to all continents.

Growth next year will come from higher margin Rx lenses which are growing 30%. TOG is very focused and proud on present very strong management in place & logistics of its warehouses in USA (Missouri) and Poland. This is key as it allows quick delivery -and cost optimization. Strong & astute management is often lacking in many companies I visited over the years. TOG makes a point to state is excels in this. I asked in China was a competitor and the answer was "yes".

Solar Farm energy on factory roof tops is complete and pictures are shown 1st phase 1.9 mgw and 2nd 0.5 mgw. Upon me asking for electric savings on this, no numbers were given, perhaps its to early to tell. TOG company is very proud on being chosen “Best of Forbes Asia, under a Billion”.

See here is the link:

https://www.forbes.com/lists/asia200/?sh=e2ccb8c2772d

Realize, Thai Optical Group is one of the top 3 global dominant companies in their field of reading and viewing lenses for eyes. (not Frames and not contact lenses). This is globally a growth industry due to previously here mentioned, as the three major demographic forces: 1) Baby boomers, a huge population segment, all getting older and most in need of vision correction. 2) Young people of all ages even below age 8, due to the Myopia Generation alarming phenomena hardly ever in the news. 3) Ever more young and old people spending time on computer/phone screens, which needs vision help or correction, or protection.

TOG double digit revenue growth into next year, stock trading double the SET average dividend yield while 1/3 lower p/e ratio, vs. the SET average. Hence my strong buy view is today re-affirmed!

TOG double digit revenue growth into next year, stock trading double the SET average dividend yield while 1/3 lower p/e ratio, vs. the SET average. Hence my strong buy view is today re-affirmed!

I can now see clearly record 4th Q ’23 et profit and further upwards next year on strong global diversified demand along with increasing net profit margins due to Rx lenses being dominant and coming on stream now and ever more…with increased production up to 6.2 mill pieces from presently upped to 4.2 mill. pieces. TOG high dividend will continue as the company “has other means to finance this growth”, as quoted today by today’s Md.

TOG (11.50) is trading at a p/e of 12.4 with a dividend yield of at least 5-6% for next year, as I expect, along with double digit growth in a semi-defensive industry and far removed from slow growing Thailand. The current mkt. price of of 11.50 is far too, can we humbly say, undemanding.

Best Regards,

Paul A. Renaud. www.thaistocks.com