Solid evidence on smaller cap’s superior performance.

The presented long evidence. Smaller and mid sized capitalized SET shares remain the long term performance stars.

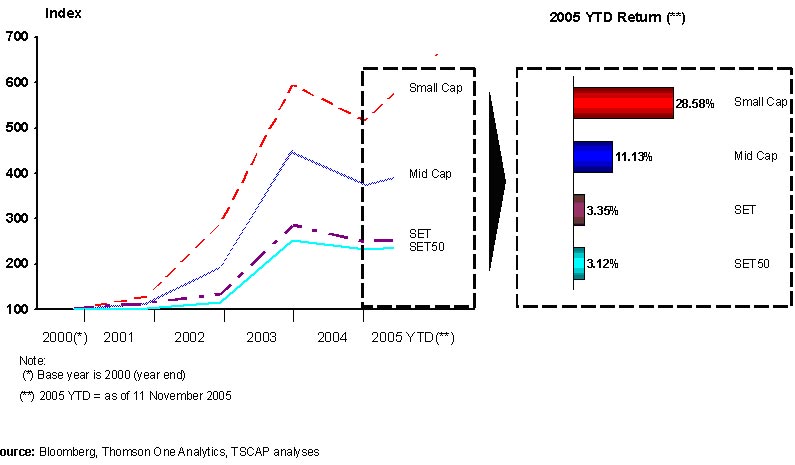

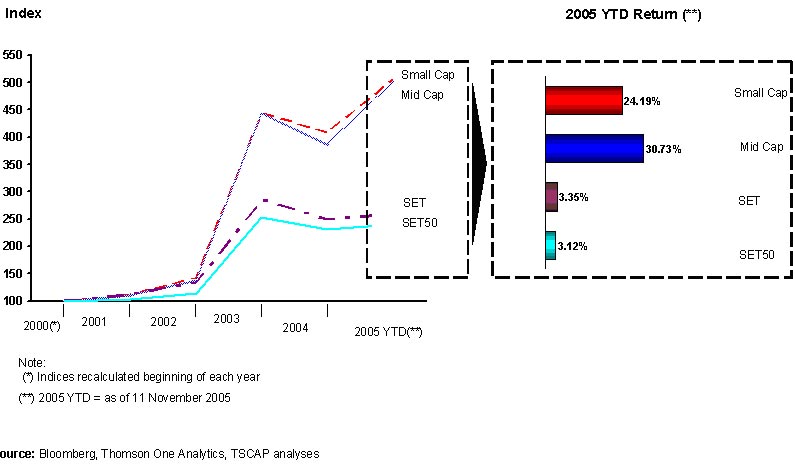

Below we show, beyond any reasonable doubt, how small and mid cap stocks regularly outperform large cap SET index shares; and this over time by and by a very large percentage, here showb since year 2000. While 2004 was a correction year for this smaller cap group, the overall long term trend is evident. This is no accident and is likely to continue, as the traders and institutions alike for the most part ignore this group and so overbid the large cap's, to their own peril.

Some observers in the past felt that this often expressed smaller cap out-performance at thaistocks.com, was "just my own view". Yet here today we all can see the solid long term evidence. To my knowledge no broker Thai or Foreign, has ever demonstrated Stock exchange of Thailand (SET) performance, as classified by different market capitalization. Here we do.

Most stock brokers are interested in their clients trading, not investing to achieve superior long term investment performance. Yet, trading is always at best a speculative endeavour. It too often results investors over time trading-out their winning positions -and holding on to the laggards. In time only so to have a bunch of laggards in ones' portfolio. The strategy is so flawed not Thai stocks.

At this web site I relentlessly since 1997, objectively seek and often deliver, "deep value ideas" in these historically outperfoming secondary Thai shares. Since 1997 these have overall been "the true -and yet vastly under-reported- performance stars". Members are regularly updated on my periodic ideas, in person company visits, and currently 3 different running model portfolios: the accumulate buy model, the core model, and the micro cap. model. All of them are outperforming the SET benchmark index to date. They are regularly revisited and reviewed.

Keep in mind that past performance can never guarantee nor promise future good results and that these stock model portfolios represent only my own views, and so are never a specific investment recommendation. Only you know your financial situation and risk tolerance.

Yet over the years, Thai stock investors whom put their over cautious mind at rest -and instead focussed on deep value shares with high dividends- have overall done very well indeed.

Best Regards,/>

/>Paul Renaud

***/>

Methodology for calculating the indices:/>

· />Market Capitalisation Definition:

· />Using the Morningstar Methodology, market cap ranges were calculated relatively

· />Large Cap: 80% of total market capitalisation; Mid Cap: 80%-95%; Small Cap: 95%-100%

· />Absolute Figures: Large Cap > 10 billion baht; Mid Cap 10 > 2.5 billion baht; Small Cap < 2.5 billion baht

· />Index Calculation is done using the market capitalisation weighting methodology used by the SET to calculate the SET Index

· />http://www.set.or.th/en/operation/indices/indices_p1.html

· />(Current Market Value / Base Market Value) x 100

· />“SMC” = Small and Mid Cap

Option 1: SMC Indices are composed by the same stocks as identified in 2000 />

/>

/>

/>

Option 2: Stocks in the SMC Indices are renewed every year based on the new market cap values/>

S

Source: Bloomberg, Thomson One Analytics, TSAP analyses.

Author: www.tonsoncapital.com

Presented by: www.thaistocks.com

<p ">