Shipping stocks sink and an analysis stink.

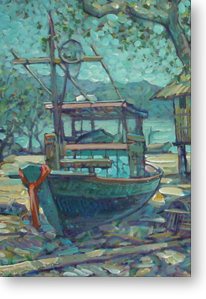

Once in a while is does not hurt to look back around mid year, even if it means patting my own back a bit, with facts. For most of last year, members will remember, I continuously stated that I liked NPC better then ATC -and that in any event, I viewed the petrochemical sector cycle longer lasting, then the my perceived, more cyclical sector, shipping. Today shipping stocks sunk in the bay.

Shipping stocks have been the big price correctors this week - this after reading buy after buy opinion from most all local and international brokers, for longer then I care to remember. I for one am glad to have stated in our member forum -and articles the now in hindsight more accurate view that :

1) Favor NPC over ATC, as the best Petrochemical stock in the sector and

2) that shipping should not be sailed with anymore, as the cycle may well be peaking. Too many bulls around and for too long. Cyclical stocks peak long before earnings do.

Looking at the oversold SET today, I accurately avoided this sector and correctly stuck with my other single view.

Of course members and viewers of thaistocks.com alike will quickly point to "my table pounding’single pick, Ticon since late last October-and here as well I can only say that in hindsight looking over the last 7 months, Ticon was a formidable place to hide and make profits and earn dividends, while the SET as a whole during this time did nothing much at all.

And speaking of Ticon, I had a chance recently to review some of the English equity research of National Finance NFS (NatSEC) on Ticon and again am amazed on how some of these brokers analyze or draw conclusions.

Ms. Phannarai, the Ticon analyst for NFS, correctly in hindsight put a "Sell" on Ticon at the market price of 11.80, back on March 17. The SET corrected along with Ticon. But her reasons seem to me flawed and of passing interest as it gives some light into how some local analysts, analyze. I here today just summarize some of these shortcomings, as it is just of passing interest. (On May 6 with the market price at then 10.10, she changes her mind on Ticon and re-rates it now a "Hold").

First of all, she keeps stating that the expected capital gain on the transfer of 39 factories to TFUND, is expected to realize an after tax profit of 423 Million Baht, to Ticon. This is most definitely understated, as I expect the gain to be booked in the 2 Quarter, to be considerably more than that. She also fails to mention that Ticon will keep owning some 33% of the TFUND.

I we mistaken about the after tax profit estimate by Khun Phannarai. She is right. Sorry about that. (May 27 '05).

"Actually she is correct in her estimate of the after-tax gain from the sale of the 39 factories to T-Fund. In fact one other estimate I just saw is around 410-420 million Baht. These property sales presents a complicated gain recognition and tax position because the Fund is treated as a connected party by virtue of their holding in the fund and the property management arrangements...

The after tax gain still represents about 0.91 Baht per share in *after tax* earnings per share gain to be booked in the second quarter. (Ticon has 463 Mill. shares outstanding). Remember, Ticon still holds around 33% of the TFUND; would they not hold this large stake the gain would be much larger. The real flaw in Phannarai's analysis in my view, is that she assings a bold and unrealistic "zero" to any future gains of more property sales to the existing Tfund or for a new fund. Why? Way over "Thai conservative" -and so unrealistic.

Secondly, she writes as if the establishment of the TFUND was late or tardy, or delayed.(?) This is just not true as the company stated from the beginning that they expected the fund to trade in the 1 Q or beginning of the 2 quarter of this year. And it did, so why ponder on that?

Thirdly, she much challenges Ticon on its ability to keep-up the pace by establishing new or expanding the first TFUND's, capital size. She correctly states that there are outside factors which may reduce the ability to do so, every year. Possible barriers stated are, a bear market, rising domestic interest rates, other competing stock investments which also have high yields, etc.. Yes, all this is possible but not probable. But then, does the proverbial gaffe, which perhaps is a bit ultra "typical conservative Thai". She goes on and assigns/concludes a zero probability -and so estimates zero future income, on any new or expanding fund. She assumes no capital gain income at all, going into the future. No mention on how REIT are rising in Asian popularity, no mention in how the first fund was successfully launched, despite the SET being in a current rut. No mention of the special tax benefits enjoyed by such a real estate funds (REIT) or how renting factories is clearly a firm market now -and expected to be in the future.

The point is (regarding my "thirdly" above), that even if one expects say a 50% probability or even say a 10-20% chance of a future event occurring, one should at least then give the expected gains a proportional estimate, -but not eliminate any and all estimates from an eventual outcome. Clearly she does not mean, nor state, that there is no chance at all of any future or expanded TFUND'! Yet her projections show a zero chance of more property funds to come, capital gains wise.

Last but not least, the expected dividend income to Ticon shareholders is for this year and beyond much understated.

It was refreshing to read this multiple page analysis, as it shows again and again that broker analysts on the SET are either over or under exited, as we just see with the shipping sector's hype, today gone. And one brokers analysis of Ticon, which assigns a zero to a probable outcome that is far from zero.

Here is the analyst name and e-mail address, we have never met.

Phannarai Vongchalee,

Phannarai.von@nfs.co.th

With all the first quarter SET earnings now announced, I still favor Ticon (9.4) but am close to shortly add a new selection(s) to my model portfolio. Keep tuned.

Best Regards to all Members,

Paul A. Renaud.

www.thaistocks.com