January 13 2013.

Anatomy of a growth stock.

UAC is my pick as a pure growth stock in a desirable emerging industry. I would rate it with a long term buy view.

UAC (8.30) which I visited 3 weeks ago is among the highest projected earnings growth company I know listed here in Thailand -and besides in a very desirable industry with no exposure to potential cyclical industries say like tourism, electronics, or consumption or EU/USA continued malaise. UAC fits well with my now entrenched investor strategy of late in overweighing the green electric/biomass/gas/biofuel emerging industry in Thailand; this along with leader DEMCO which I hand picked and licked most since year 2011 before anybody knew much about it.

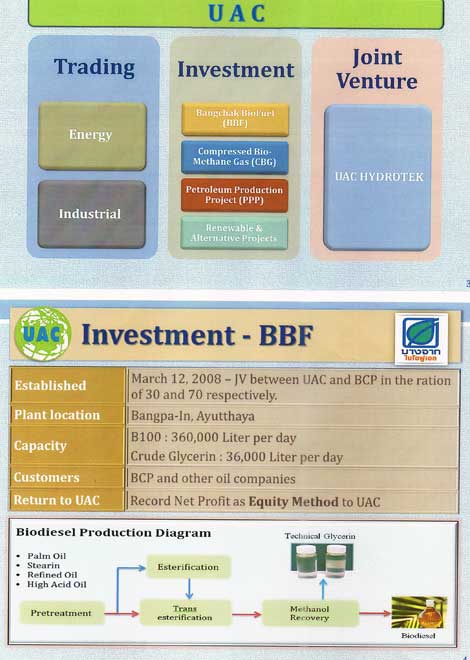

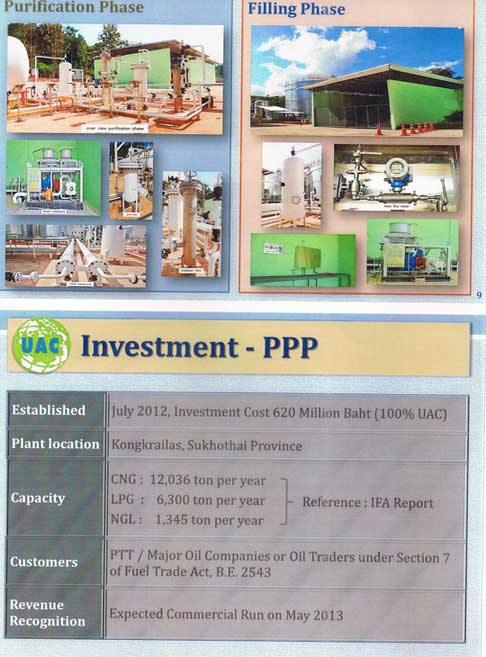

The company just placed last week 24.3 mill. new shares along with 4.86 mill. new free warrants (1 new warrant, for every 5 shares) The pricing was at 7.90 Baht per share. These warrants have a 3 year time period, starting Feb. 1 2013, and are convertable at 1 to 1 ratio, at 7.50 Baht per new share. This public offering (P.O) was sold out at once and heavily over-subscribed -with fewest if any retail investors getting any allocation.

While UAC’s p/e and valuation will appear high to strict value investors, I am convinced its high earnings growth rate is nearly assured for this year and even to accelerate into year 2014 and likely beyond. With this industry clearly emerging and higher trading volume and market cap. among the key players, I could see this stock around 12 Baht per share sometimes within the next 12-18 months. Time will tell. UAC is a model portoflio selection.

Here you can see a broad summary of UAC, as is shown by the SET:

http://www.set.or.th/set/factsheet.do?symbol=UAC&language=en&country=US

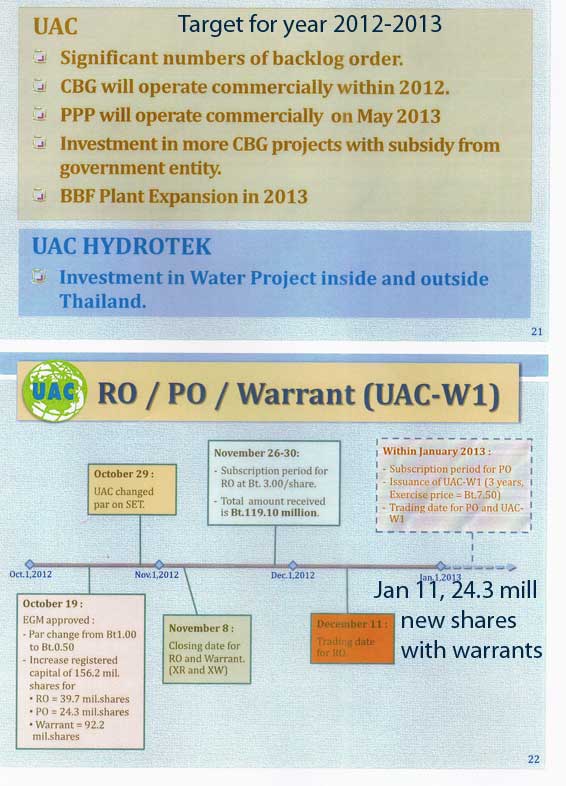

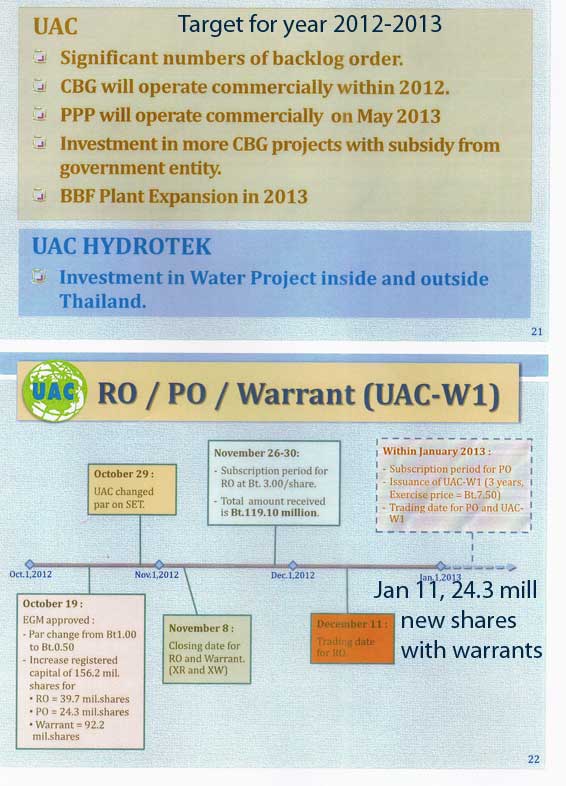

Because UAC sees renewable/green energy as an essential for the future business, this company began in the CBG business in Chiang Mai and a PPP in Sukhothai. With success of the first CBG project already in place, UAC has initiated 20 additional projects, which should be completed within the next 2 years. (see more details below).

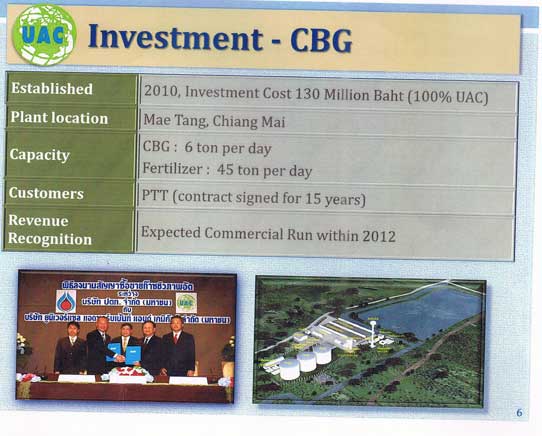

First an UAC an overview of its core business:

Imported chemicals. The primary business of UAC is the importation and sale of chemicals and equipment used in the energy and petrochemical sectors. UAC now has a total paid-up capital of Bt198.4mn (Bt0.50/par) trading on the MAI board since October 2009, where at the time it had an IPO price of Bt4.00/ with par 1, The majority shareholder stake is held by Mr. Kitti Jivacate (57.3% as of 2 October 2012). Reported insider stock transactions only show buying of minor amounts of shares in year 2011 and nothing since.

Core business to date has been service/trading. UAC has long expertise in petrochemical products and related-equipment and is the distributor for many world class petrochemical products made by UOP, LCC and PALL Corp. UAC also sells absorbents and molecular sieves, filtration for gas explorers and producers, refineries, petrochemical plants, lube-base oil mixers, polymer, plastics, power and the utility industries. UAC is also a distributor for MEG and DEG used in the painting industry, as well as, solvents used by textile, polymer, engine oil, fuel oil Revenue from Energy and Petroleum account for over 70% of the total. Thailand’s refinery capacity has increased near 6 fold over the past 12 years, from around 200 mill bbl per day, to currently 1100 bbl per day.

A first in Thailand. (Pig waste into LPG gas-CBG)

UAC is now already operating a most impressive CBG plant in Chiang Mai producing 6,300 LPG tons per year. It plans to construct 20 more such plants over the next 2 years. The Thai Energy Ministry provides a 10 mill. Baht grant for each such a plant. The technology comes from Germany and Switzerland -and the final waste product, after producing all that gas, is 20 to 30 tons per day of a non-chemical fertilizer. It also allows such pig farms to expand if they want as the smell polluting to the neighborhood is now at not an issue due closed system which nearly eliminates this. UAC has a 15 year agreement with PTT to buy all the bio gas from such operations. LPG gas prices are here set to increase, (start floating), in March according to recent press reports -this is so yet another positive for UAC. Thai LPG gas prices will very likely increase soon bringing UAC earnings to beat current earnings estimates.

Here is more on this CBG endeavor. (Compressed Bio Methane Gas)

UAC sees a shortage of NGV and also an actual high NGV cost problem for PTT in northern Thailand. UAC has co-operated with the Department of Alternative Energy Development and Efficiency and the Energy Research Center, at Mae Jo University, to develop a project called “Developing bio-methane gas from swine for transportation” in the year 2011. UAC has rented some swine farms in Mae-Tang, Chiang Mai for 18 years to use the waste from these farms (40,000 swine) mixed with Bana grass bought from regional farmers and fermented by them. When UAC receives the bio-methane gas, UAC will adjust, separate the gas and compress it, resulting in an equivalent to CNG gas for use in automobiles. The waste from the fermentation can then also be sold as a leavening non-chemical fertilizing agent.

Giant PTT agrees to purchase all CBG from UAC. UAC invested in this first CBG project from its internal cash flow and loans from banks (Projected D/E is 2: 1). Project construction began in 2011 with the start up of operations in November 2012. CBG output is 6 tons per day. PTT views the use of CBG instead of CNG in the north will help reduce actual CNG costs and thus PTT has agreed to buy all CBG for 15 years (then extendable every 5 years). This project has BoI privileges and is tax exempt for 8 years with a 50% tax discount for 5 additional years.

This initial Bio-Methane gas project will source animal dung from nearby farms (5 km away). The mix of Bana grass also helps reduce epidemic risks and secures more resources for the process. The attractive purchase of Bana grass at Bt1/kg also attracts farmers to produce the Bana grass which has a short 3-month growth cycle, thus farmers will earn more compared to other agricultural crops (Note Bana grass output is around 70 tones/rai/year equivalent to an attractive income of Bt70,000/rai/year).

CBG project adds Bt87mn value to UAC with over 16 developing plants. (In our meeting I was told 20 such plants will now be constructed over the next 2 years.

Based on the sales contract period of 15 years with PTT, the CBG project will add Bt87mn value to UAC, or an implied IRR of 23.8%. Furthermore, UAC is now waiting for approval to invest in 20 other projects with a government subsidy of Bt10mn per project, totaling of 200 mill. Baht. UAC will operate 10 of the 20 projects itself; while the other 10 will be run by regional farm owners (UAC holds 51% stake each). The 10 projects will be located in Chiang Mai, Chiang Rai, Lampoon, Lampang, while 4 projects will be located in Khon Kaen and 2 in Loei. UAC targets all projects to be completed by end of 2014. I expect these 20 projects will contribute 1.5 bill. of revenues to UAC by end of 2014.

Bio Diesel on the rise.

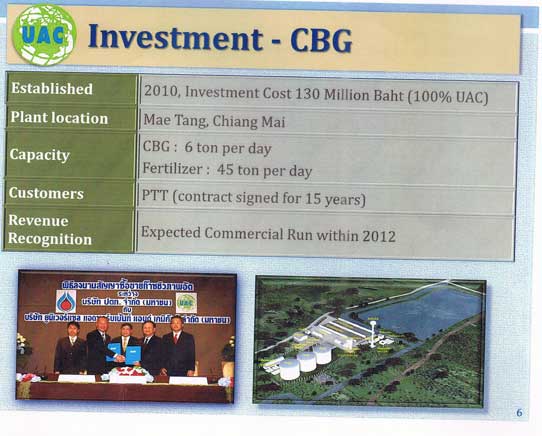

The company also produces Bio-Diesel B100 sold mainly to BCP to mix with Diesel for Diesel-B3 and Diesel-B5 motor fuels. UAC recognized a share of profit from Bangkok Bio Fuel Ltd. (BBF), which is a joint venture with Bangchak Petroleum Co., Ltd. (BCP) with paid-up capital of Bt281.5mn (UAC holds a 30% stake).

Currently, BBF operates at full capacity of 360,000 liters/day, which also generates Glycerin of 36,000 liters/day, as a by-product sold to industrial customers. In 2010, 2011 and the first 9Months of ‘12, BBF generated Bt76mn, A second plant of bio diesel through palm oil waste if now planned. The price of which is still 20% cheaper then regular diesel fuel at the present. The price of diesel fuel in Thailand will likely at last be deregulated within this year which would be a further positive. None of the last 2 events are incorporated in the already high earnings progression I estimate.

"Thailand just cannot afford to keep subsidizing the price of diesel". K. Kitti Jivacate President and CEO of UAC.

Global sales of diesel cars will rise 66% between year 2010 and 2018 to 22 million cars, by then making up 18%% of total vehicles in 2018. Growth will come mainly from N. America Eastern Europe and Asia. According to LMC Automotive.

Clean Water.

The company also is in a joint venture with winning Hydroteck to produce and distribute water supply, purifying naturel waters and filtration systems around the region, which will be consolidated to UAC’s financial statements this year and beyond. Customers be industrial zones and provincial municipalities. A 300 mill. Baht UAC/HYDRO water project in Burma is planned for year 2014. Both HYDRO and UAC stock prices have recently set new all time highs -and for good reasons. The current correction is another entry point opportunity to long term growth stock investors.

After a great visit with this company, I project revenues to grow to 900 million Baht this year and grow further 25-30% next year -and some 50% in year 2014. The company’s core business is also doing very well with higher profit margins due to more service vs. trading revenues. The company’s revenues were already 630 mill. for the first 9 months of year 2012 -and its profit margin is on the increase (see below).

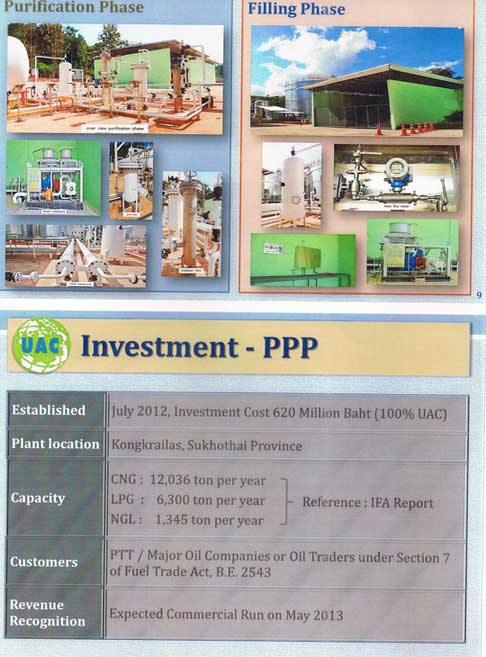

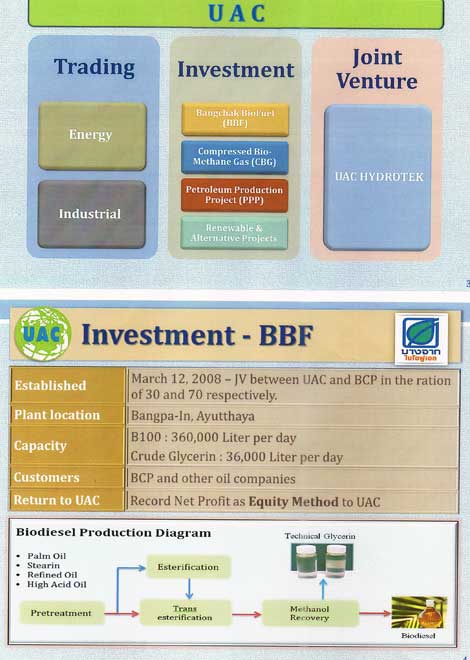

Here is my take on UAC’s PPP project, called the Petroleum Production Project. Another winner.

Background. UAC sees a petroleum production problem of disposal of associated gas’ (waste product for now so not used), hence UAC plans to set up a plant to separate the associated gas from the Burapha-A oil field in Krong Krai Lat, Sukhothai, invested in with Siam Moeco Ltd. and GS Caltex Corporation (70% and 30% stakes, respectively) with a 20-year concession. By-products from this separation plant for the associated gas are CNG 61%, LPG 32% and NGL 7%. PTT has already signed a contract to purchase all the CNG gas, while UAC is negotiating with other customers for the LPG and NGL. This is a 620mn Baht capex. According to a projected D/E of 2:1, 206 mill. Baht for the project will come from the current capital increases.

The raw material resources there will be sufficient for next 20 years. UAC has signed sales contracts to buy associated gas from the oil rig (3-year contract extended automatically). Also Siam Moeco Ltd. has received a 20-year petroleum concession for 6 fields and thus this resource should be sufficient for UAC for many years to come.

755 mill Baht value to UAC. One can assume UAC will be able to extend the contract until the end of the oil concession in 20 years and I expect the 2013 forecast capacity of this gas separation plant at 50% -then increasing to 100% in 2014. Assuming gas received from this oil field is sufficient for the PPP operations, the PPP will be worth 755 mill Baht in value to UAC or the equivalent of an IRR of 26.3%.

UAC has already constructed the civil work in July 2012 and expects the EIA to be approved shortly, before commercial runs in mid 2013. This gas separation plant has a total production capacity of 19,681 tones per year (including CNG 12,036 tones, LPG 6,300 tones and NGL 1,345 tones/year). The plant will be tax exempt for 8 years.

http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=UAC:TB

Here is some further information on UAC from its annual report and other sources:

“From the past to the present, the Company:s main business has been an importer and distributor of chemicals and equipment used in various industries such as natural gas exploration and production, oil refinery and petrochemicals, lubricant, polymer and plastic factories, chemical industrial plants, power plants and utilities system including expansion into oil industry as an distributor of several producers in distribution of various products such as basic lubricant, engine oil additives, brake fluid, and chemicals used in the production of engine and vehicles oil, the company also invested in alternative energy such as biodiesel with Bangchak Petroleum Public Company Limited via its associated company.”

“In order to improve profit and create future value to the Company's shareholders, the Company plans to expand into alternative energy and other public utilities business and also support the government's policy of enhancing energy security by diversifying sources of energy for sustainable future growth. To be consistent with the Company's future plan and the government support on energy by maximizing usage of energy and effective cash management, Universal Adsorbents and Chemicals Public.”

“Company Limited, with experiences in chemicals, petrochemcials, oil refinery, and natural gas has realized that the production of the petroleum products used gas as a by-product from petroleum production of Burapa-A of Siam Moeco Limited to transform into other petroleum products to use as energy, The products are:

1) Compressed Natural Gas (CNG);

2) Liquefied Petroleum Gas (LPG); and

3) Natural Gasoline (NGL). On November 4, 2011, the Company received a Letter of Intent from Siam Moeco Limited indicating its intention to jointly develop the Petroleum Production Project whereby Siam Moeco Limited will provide gas as by-product of petroleum production to be used as major raw material in the Company's Petroleum Production Project. \

The Company's Board of Directors meeting No. 5/2011 held on November 10, 2011 resolved to approve hiring of Udhe (Thailand) Co., Ltd. to provide a preliminary basic and details engineering design of the construction of the Petroleum Production plant in Sukothai province in the amount of Baht 20 million. The Company's Board of Directors meeting No.3/2012 held on May 11, 2012 also resolved to approve the construction of the Petroleum Production plant in Sukothai province with total capacity of 19,681 tons per year consisting of CNG of 12,036 tons per year; LPG of 6,300 tons per year; and NGL of 1,345 tons per year with total investment value of Baht 619.82 million or Baht 620 million

“In consideration of the appropriateness of the transaction, the Independent Financial Advisor is of opinion that the investment in the Petroleum Product Project is feasible and will help diversify the Company's business from trading and distribution and will enhance the opportunity to generate revenue on a continuing basis. Since the selling price of domestic natural gas is lower than its neighboring countries, the launching of Asean Economic Community (AEC) in 2015 will result in rising in natural gas price and positively impact on the project. In addition, the project will serve to optimize the Company's working capital. In terms of Corporate Social Responsibility (CSR), the project will help support the government's policy on development of energy sources to substitute the imports and enhance the optimization of the resources in addition to the reduction global warming which has gained attention on a global basis.”

The total investment value of the Petroleum Product Project is approximately Baht 620 million.

“The Independent Financial Advisor has an opinion that the Shareholders should approve the transaction of investment in the construction of the Petroleum Production Project. Although the Independent Financial Advisor is of opinion that such investment is reasonable, there are several factors which are still inconclusive such as volume and quality of the raw material, uncertainty of the future selling prices which are dependent upon the government's policy. If there are material changes on such factors, the projection of the operation of the project could deviate from plan.”

Subsidiary

The company commenced development and operations of a compressed bio methane gas (CBG) project. During the period years 2011 and 2012. It already finished constructing a CBG production plant at Mae Tang District, Chiang Mai Province. Constructing of such a CBG plant was completed and commercial operation began in November 2012.

UAC and HYDRO:

UAC has a 49% owned subsidiary called UAC Hydrotek Co. Ltd, incorporated on April 8th 2011. For the purpose of engaging in the business of producing and distributing tap water to be used in the industrial and household sector and distributing & installing involved equipment UAC/Hydrotek has a total registered capital of 10 mill. Baht.

Associate company

The company has one associate company called Bangkchak Biofule Co. Ltd (BBF) in which the company and Bangchak Petroleum PLc. Hold respective proportionate of 30% and 70% in its total paid up capital . BBF is engaged in the business of production and distribution of biodiesel fuel which is liquefied fuel to be used as an ingredient to mix with diesel oil obtained from petroleum production process to obtain variety of biofuels, such B3 and B5 biodiesel.

Here are some recent financial ratios:

Net profit margin has increased from 5.3% (year 2009) 13.9% (2010) 8.3% (2011) to currently 16.4%, annualized for last year 2012. Operating margin increased to 14.5% in the 3Q ’12, from 12.1% for the 2 Q. ’12.

Net Profits have increases from 37.8 mill (2009) to 108.1 mill (2010) 80.2 (2011) to currently 102.28 mill. Baht, but for just the first 9 months of 2012.

ROE has increased from: 23.35% in year 2009 to 29.48% for last year.

UAC is able to control fixed costs well and interest expense is negligible.

I estimate the UAC net profit to grow at least 35% CAGR over the next 5 years (2012-2016) supported by the 1+20 CBG projects and the PPP. The trading business will continue to grow as well. The CBG and PPP projects contribute high gross margins, and so I believe the UAC gross margin will increase from 16% in 2011 to some 31% in 2016. Given the strong earnings growth prospects, I expect a respectable dividend yield of say 3-4%, with an impressive 22% ROE or higher, going forward.

Recently the company has had a number of capital raising programs most notably to be used in business expansion and investment in alternative energy projects. Currently the company has 436 million shares outstanding with a PAR value of 0.50 Baht. 60% of the shares belong to Mr. Kitti Jivacate, a key insiders and the President and CEO. The company employs a total of 25 engineers and 69 employees.

Projections/Valuations.

--For this year I see 1.2 mill. in revenues or 210 mill. in profit, or an estimate of 0.46 Baht per share, this comes to a forward expected p/e for year 2013 of 18.

--For year 2014 I project 1.7 mill in revenues or 300 mill. in profit for an estimate of 0.62 Baht per share this comes to a forward p/e for year 2014 of 13.2

This is not over demanding in my view when considering the p/e of the SET is not much lower even while the growth rates for the average SET company is far less then this pure growth stock in a defensive industry. Many large cap stocks trade at similar high valuations despite far lower growth rates and in my view, less desirable sectors.

Some of the Key risks.

+ A delay in the CBG and PPP projects will have a significant impact on our earnings as these 2 projects account for 33% of our FY13 revenue. This is unlikely as the government is a strong supporter of viable green energy projects.

+ The change in government policy. Should the government cancel support for the CBG projects, UAC would need to seek additional capital of 10% (or Bt130mn) to compensate for the missing subsidy from the government (Bt10mn per project). However, with a low d/e of 2:1 for each project and the low d/e ratio of 0.24x on UAC, I think UAC will be able to access the needed capital.

+ A SET market correction which could pull down higher p/e stocks more then lower high dividend yielding ones.

My take on this extensive review here, my company visit and based on other stock choice alternatives in the SET, along with UAC’s clear lower overall cyclical risk, is to rate the company as with a long term buy view.

Best Regards,

Paul A. Renaud.

www.thaistocks.com