The more innovative and with better adopting strategies.

When corporate harmony & equilibrium is more cherished over creative & critical responses, decline sets in; this is what reflects the ever shifting struggle between maintaining equilibrium and yet allowing innovation.

The ever increasing tension between the preserving forces of tradition -and the transforming forces of change.

Can especially the Thai large cap companies cope well with this in future? While blue chip companies are often defined as being large and dominant and so viewed as "more stable", they are nevertheless prone to big risks over time, as the record shows.

Yet large institutional funds must only consider these for their stock investments. Below I recall some realities too often browsed over in elite boardrooms. "Equilibrium is a precursor to death. When a living system is in a state of equilibrium it is less responsive to changes occurring around it. This places it at maximum risk." * In the best selling well know book "In Search of Excellence" Bob Waterman and Tom Peters list the qualities that in their learned view contributed to the high success of 43 excellent global large cap companies. Since the publication of this book managers the world over have sought to emulate those desirable traits eloquently listed in the book.

Key among them was strong values, great deal of internal consistency and clear corporate vision; all more known as "organizational fit". Yet, I for one am glad to never have read this book! As within 5 years of their publishing, half of the 43 companies were in trouble and by year 2001 all but 5 have fallen from grace. Perhaps they had encouraged managers to pursue the very equilibrium that would prove their undoing.

As in an ever fast changing business world, "equilibrium is death". Thailand take notice, as yesterdays peacocks can be tomorrows feather dusters. Too many large companies view its past as highly sacrosanct rather then suspect which so then fails to address the profound coming challenges of authentic transformation and renewal. Some of us will remember one at the time's shinning example, nearly gone down, namely IBM. This company in their own internal memos saw it all coming, well before its own steep decline in the 1990's. Namely, the PC's, higher margins of software vs hardware and open architecture, intelligence in the networks etc..

Yet, horribly so, senior management changed nothing other then rise hardware prices to cover their shortcomings. In arrogance, they refused to change -and so nearly died. Or, consider the US Fortune 500 companies of 30 years ago. Surely, in those days, the prominent list of "whose who" in America's big cap. firms. Today, few are still around, or on the top! Incredibly so, it’s a story of declining survival rates, as I witnessed during my own generation. Here is the undisputable record around those, since: During the relative tame period of 1976 to 1985, some 10% of those 500 fell by the wayside. Move-on to the more disorderly period of 1986 to 1990 when this attrition rate jumped to 30%. In the next 5 years, 1991 to 1996, the attrition rate rose again, this time to 36%.

Clearly a rather very significant percentage of those blue chip companies failed to mobilize the level of response needed, to sustain themselves. With falling by the wayside I mean failed to grow as rapidly as their peer group, got merged or were acquired, or as in some small fraction of cases went bankrupt. Some got acquired when they surely would have preferred to have been the acquirers.* Then there is the old "hall of fame" Xerox Corporation. This company invented the first PC, named the Alto, the first commercial mouse, many of the basic protocols of the internet client server architecture, laser printing and flat panel display just to name a few of its numerous and outstanding contributions at the time.

Yet, because senior management did not recognize and so would not embrace these new revolutions at the fringe, Xerox was left in the backwater of these new vast wealth creating opportunities of the past 30 years. Perhaps one day Xerox seniors will warrant a place in "the corporate hall of shame".

Arrogance combined with raw equilibrium complacency was the cocktail mix of their decline and they are hardly a rare exception. "The first rule of business is also the last rule of business: adapt or die." Fast Company. Smaller companies in general adapt faster -and with less arrogance. Large companies in contrast far too often preserve, in this ever faster changing world, the moribund equilibrium and authoritarian attitude and so in time plant the seeds of their decline. It is all part of their own cultural big cap. baggage. While I know this is a generalization, still: large cap companies the world over are known to lack adaptive leadership which is defined as "making happen what isn't going to happen otherwise". While corporate longevity among large cap companies has actually decreased over the past 50 years, medical sciences have increased human longevity by some 50% during this same time period. Ask yourself why this is so?

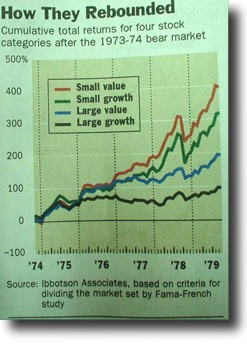

The graph on the right shows how small cap stocks way outperformed in USA during a difficult bear market cycle, as is now in place on Thai SET. Yet, I am convinced that when the market here recovers, smaller cap value shares will remain performance leaders in time. Corporate executives, especially at large cap. companies, are just not very good at "disturbing the equilibrium"; which is often what is required for adaptive behavior in a chaotic world which -ever increasing in this century.

The graph on the right shows how small cap stocks way outperformed in USA during a difficult bear market cycle, as is now in place on Thai SET. Yet, I am convinced that when the market here recovers, smaller cap value shares will remain performance leaders in time. Corporate executives, especially at large cap. companies, are just not very good at "disturbing the equilibrium"; which is often what is required for adaptive behavior in a chaotic world which -ever increasing in this century.

In Thailand I fear this problem of high ranking big cap executives at the top -and then missing the mark, is even more a danger. As they seem to overly cherish the equilibrium and cultural authority and this is ever more of an acute problem going into the future. Too often creative new ideas, from further down the employment chain, are just ignored, as this can be viewed "Thai cultural impolite" when expressed by rank inferiors. Suggestions or critique, if given at all, then routinely get ignored by the top echelon -whom after all "know best".

In Thailand harmony & equilibrium is cherished over creative & critical responses -and while this has some advantages at times, these are less so as we move-on, into the ever more turbulent future. Time will show this to be the case. *** While blue chip companies are often defined as being large and dominant and so viewed as "more stable", they are nevertheless prone to big risks over time, as the record shows.

And while large institutional funds must only consider those for their stock investments, you and I should remain a fan of the select more creative many smaller cap firms here. These remains undervalued, more innovative and with better adopting strategies. They have proven, over many years to on average to be less volatile while paying higher dividends, until their stock prices eventually increase. Documented again and again this surely has been the case here on the Thai SET for many years, and I remain convinced these will remain the investment performance leaders in the future -as they have in the past.

Best Regards,

Paul A. Renaud.

* See the excellent book "Surfing the Edge of Chaos", by Richard Pascale Mark Milleman and Linda Gioja. Three Rivers Press, New York.