LVT, strongest buy view stated.

As for more on LVT (1.79).

What a great defensive play at lowest valuation, high growth and double digit dividend of 0.25 to 0.30 per share very likely early next year, while you wait.

I now think the dividend will likely be 0.25 to 0.30 per share or 13.8 to 16% yield, on its current price. Remember the net profit margins are a high 15-18% for LVT so on a backlog of 2.5 Bill. this represents huge earnings in the coming couple of years and likely beyond due to this company's niche market. LVT is one of the best in what it does worldwide and benefiting from a rebounding US$. The warrant conversion early next year might increase trading volume some and will dilute earnings per share, as previously noted.

Fully diluted with the upcoming warrants I see around 0.55 EPS for '08. If you assume the dilution should only start next year '09, as only then new shares are trading, the EPS for '08 is around 0.84 Baht, or for a current year 2008 p/e of 2.15 !

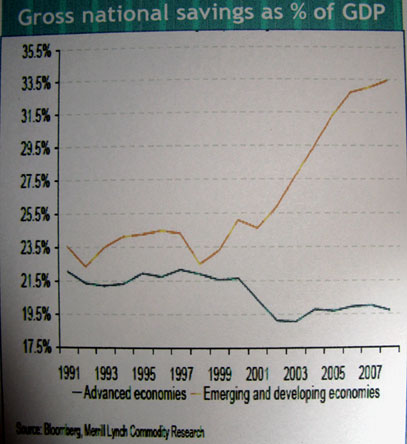

The company has a strong team, global diversification into emerging countries with their highest savings rates and huge $ reserves across the board. Their Indian associate company is highly successful with huge furhter potential. LVT works on a fairly short "start to completion" time period so the 2.5 Bill. Baht backlog figure I just got, raised my eyebrows further. I would modestly rate LVT a strongest buy on today's closing price of 1.79.

Best Regards,

Paul A. Renaud.

www.thaistocks.com