Huge premium for US small cap's vs. big discount here.

The Thai stock market dichotomy to be taken advantage of.

In Thailand there are and remain all kinds of great smaller and mid sized growth companies which trade at single or very low double digit p/e's, starting with a 1. Yet, only to mostly be ignored by the mega institutions, Thai brokers, Quant and ETF funds.

Compare this to the US "Russel 2000" index (a smaller cap index) in the US, where as is reported in the Bloomberg in late March, the average stock in that index trades at p/e's of between 40-50 -and yet still have been the absolute stellar performers for many, many quarters to date. In fact, the Russel 2000 index has had one of the longest streaks of out-performance in decades.

If you some pro's its not least because US interest rates remain low and hence the many rational investors there pay a premium for such higher perceived smaller growth stocks, during this environment. Rightly so as growth is higher valued during lower interest rate environments. US smaller cap. stocks pay very little cash dividends vs. dividend rates for smaller cap. stocks often bring twice the yield, as compared to Thai large cap's.

Even if you prune this US list down to say a more reasonable p/e's to the low 20's (say by taking out all stocks there which do not have any earnings), then small cap's in the US still trade at a near 50% premium to USA big cap's, averages. Ask yourselves why this is.

As this is just the opposite to here (!), where Thai smaller cap's trade at a considerable discount as compared to large companies. Does this make sense? Here is the key investment theme here for alert individual investors to grasp and understand. I have been the sole voice here for a long time pointing this dichotomy out. Do you visitors here know of a single source, anywhere, which mentions this oddity -in any way, shape or form? I bet not.

As lone voice here, having pointed this out here for years and how it makes no sense and hence is a great value investor theme! Smaller cap's stellar performance way well be overdone in the US presently. Just as they remain well under-discovered here. Yet nobody writes about this. Its this investor theme we here excel around -and the long track record shows it.

Best Regards,

Paul A. Renaud.

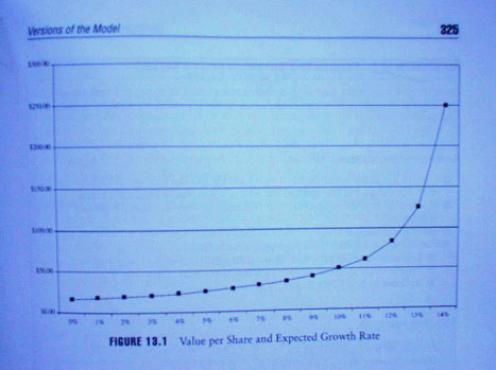

The below picture from a Finance Textbook, shows how future earnings growth rates demand much higher valuations (p/e's). Yet in Thailand its so often the opposite.