Here is an original subscriber article on Banpu.

Here is an original subscriber article on Banpu. We thank Robert Thayer CFA for this original contribution on comparing two similiar firms. One operating in Thailand and listed on the SET, the other in USA. Original Subscriber Article as exactly published last September 1 '00. We thank Robert Thayer CFA here again for a new outstanding contribution on comparing two similiar firms. One operating in Thailand and listed on the SET, the other in USA. The Thai firm is a larger company with much trading liquidity and one of the few big cap. stocks we now firmly advocate.

Either way, generating electricity in Thailand is a growth business!

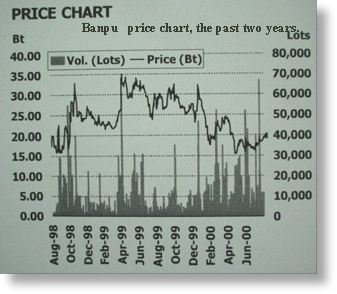

Banpu (19) is our number one large cap. stock selection because it fits both as a Value Stock, as well as an earnings momentum story; as among other good thins Banpu is an indirect beneficiary of higher oil prices. Banpu is set to expand it’s electricity production for Thailand (EGAT) and it’s cheap coal from Indonesia will be supplied at high profit margins. Last year some 60% of Banpu's sales came from coal sales. Because of the new technology called "clean coal technology", we believe coal will be an important substitute to alternatives when it come to generating clean electricity. Clean coal fired electric plants are now a viable alternative to Gas and Oil. Banpu's Indonesian mine called "Jurong" has huge amounts of reserves of low sulfur coal.

Three additional items we wish to point out regarding this favored stock:

- "The share offerings for Ratchaburi Electricity Generating Co Ltd, THAI and Bangchak Petroleum Plc would be completed by the end of this year,…. "According to the privatisation timetable, Ratchaburi will launch its public share offering in mid-October," the government official said. This is good news for the Energy sector as it will much focus analysis on this sector and so then Banpu will be fully discovered.

- Banpu has very large hidden assets on it’s balance sheet and now converting these to earnings. Hence we believe the book value is understated and it’s Net Asset Value (NAV) probably closer to 90 Baht per share.

- At press time the Tisco Analyst (Thai Securities) published an impressive updated report on Banpu:

"BANPU/BUY Latest meeting still confirm our positive view of the company. The improvement of the Jurong mine will raise its profit margin from 9% in FY00 to 25% in FY01. Proceeds from selling off COCO shares will be used to retire its debts which in turn will reduce interest expenses and boost earnings. The company is under talk to acquire 50% stake in a local SPP with capacity of 150MW with an investment of Bt1bn or cost /MW of $0.33m which is low versus $0.5m avg. After that BANPU will have total 356MW in its portfolio. The company plans to buy back more ECD. At end of FY01, it has an outstanding ECD of $57m. It has bought back $11m of ECD so far in 1Q01 at avg. premium of 8%. This will be booked as extra expense in 1Q01 of about Bt35m. On the earth removal project, the outcome is due out in early Sep. Without the value of this project, BANPU's NPV will be at Bt40/share."

"BANPU/BUY Latest meeting still confirm our positive view of the company. The improvement of the Jurong mine will raise its profit margin from 9% in FY00 to 25% in FY01. Proceeds from selling off COCO shares will be used to retire its debts which in turn will reduce interest expenses and boost earnings. The company is under talk to acquire 50% stake in a local SPP with capacity of 150MW with an investment of Bt1bn or cost /MW of $0.33m which is low versus $0.5m avg. After that BANPU will have total 356MW in its portfolio. The company plans to buy back more ECD. At end of FY01, it has an outstanding ECD of $57m. It has bought back $11m of ECD so far in 1Q01 at avg. premium of 8%. This will be booked as extra expense in 1Q01 of about Bt35m. On the earth removal project, the outcome is due out in early Sep. Without the value of this project, BANPU's NPV will be at Bt40/share."

***

Banpu, a big cap. value stock to own now. By Robert Thayer CFA.

www. Thaistocks.com is recommending Banpu as a strong play on Thailand’s rapidly developing energy sector. Today we compare Banpu to a similar U.S. company, Arch Coal (NYSE:ACI). Analysts project similar long term growth for both companies, but we’ll conclude that Banpu’s projected growth can be purchased at a lower cost and with lower risk. Written for Thaistocks.com by Robert Thayer, CFA. USA.

Banpu Public Company Limited is the largest private sector coal mining company in Thailand. Banpu also mines industrial minerals. The Company’s experience with large mining operations also earned it a 10-year contract for removal of overburden and lignite for the Electricity Generating Authority of Thailand (EGAT). Banpu has been aggressively expanding its international business, as well, with coal production and calcium carbonate mining in Indonesia. Banpu plans to diversify its product sales to other SE Asian countries. Thaistocks.com’s has written various reports on Banpu, which can be best seen under "what’s new?" or by using the search function. Arch Coal is the second largest coal company in the U.S., producing one-tenth of the country’s total coal supply. The vast majority of this coal is sold to U.S. electric utilities. With 120 million tons of annual production, Arch's mines provide the fuel for approximately 6% of the electricity used by Americans each year.

Arch controls diversified domestic reserves totaling 3.5 billion tons, 90% of which is low in sulfur and 66% of which meets the Phase II requirements of the Clean Air Act. The company operates mining complexes in six states and three major coal-producing basins. In 1999, Arch shipped its products to 140 power plants operated by 68 utilities in 30 states. In addition, Arch exported coal to utility and industrial customers in 10 foreign countries.

Merrill Lynch publishes regular updates on the coal industry. Analysts Dan Roling and David Gagliano recently made the following points:

- Coal remains the dominant provider of fuel for power generation in the United States with a 51% market share.

- Through the first half of 2000, overall supply/demand fundamentals continue to show significant signs of improvement. A substantial increase in year-over-year demand has been met with declining supply, resulting in a somewhat tighter coal market than in previous years. Merrill looks for continued improvement in supply/demand fundamentals as a number of positive industry factors are coming together. They forecast 2000 coal production growth at 1.9%.

- Merrill looks for a general trend of stabilizing coal prices over the next 1-3 years, following the period of steady decline that began in 1982.

A recent Morgan Stanley Dean Witter report noted that almost all newly built power plants will be fueled by natural gas because natural gas power plants are much cheaper to build than coal-fired plants. Coal-fired plants, however, are cheaper to operate.

Today, however, coal fired plants are only operating at 68% of capacity, says Merrill. The lower operating costs and available capacity should act to boost coal demand faster than demand for power generation for some time to come.

Comparison. Both Banpu and Arch are coming off a year of financial and operating restructuring. Banpu divested some of its non-core investments and acquired new coal mining leases in Indonesia. Arch closed some mines and expanded operations at others. Each took substantial non-cashflow write downs in the last fiscal year, which drove earnings into the red. Arch’s earnings have also suffered this year from an unexpected closure of one of its big mines due to the discovery of poison gases.

Here’s the side-by-side comparison:

ACI |

BANPU |

|

|

SIZE |

||

|

Last FY Sales (millions) |

$1,510 |

BT 4,723 |

|

Market Capitalization (millions) |

$270 |

BT 1,991 |

|

ANALYST ESTIMATES |

||

|

Current FY Est. Earnings per Share |

($0.50) |

6.00 |

|

Next FY Est. Earnings per Share |

$0.20 |

8.00 |

Year over Year Estimated Growth |

140.0% |

33.3% |

|

Estimated long term growth rate |

20.0% |

20.0% |

|

MARKET PRICING (Current Year Est.) |

||

|

Price/Book Value |

1.2 |

0.5 |

|

Price/Cash Earnings |

1.0 |

1.5 |

|

Price/Estimated Current Earnings |

- |

3.2 |

|

Market P/E |

26 |

7.5 |

Discount to Market P/E |

- |

58% |

|

FINANCIAL HEALTH |

||

|

Recent Working Capital Ratio |

0.7 |

1.0 |

|

Debt/Equity Ratio |

5.0 |

0.30 |

|

RETURN TO SHAREHOLDERS (Current Year Est.) |

||

|

Profit Margin |

-1.1% |

11.7% |

|

Asset Turnover |

0.60 |

0.44 |

|

Financial Leverage |

9.83 |

2.08 |

Estimated 2000 Return on Equity |

-6.5% |

10.6% |

|

Estimated Current Year Dividend Yield |

3.3% |

5.6% |

|

TRADING |

||

|

Average No. Shares Traded Each Day |

70,000 |

800,000 |

|

Dollar Value of Daily Volume |

$770,000 |

$380,000 |

|

AVERAGE ANALYST RATING |

Buy |

Strong Buy |

Banpu data from Thaistocks.com research

ACI data courtesy of Merrill, Lynch, Pierce Fenner & Smith

Analyst Recommendations. Banpu is recommended by Thaistocks.com and four major Thai brokers. Four of the largest Wall Street brokerages cover Arch, and all justify their "Buy" ratings on the outlook for coal demand and Arch’s currently depressed share price. Earnings Outlook. Thaistocks.com’s Paul Renaud looks for Banpu to produce 6 Bt/share operating earnings this coming fiscal year (ended Jun’01) and 8 next year. Mr. Renaud’s estimate is higher then the consensus but he says an analyst at S-One (Mr. Pichaia) is projecting 9 Baht per share, this coming year but inclusive FX gains. Either way Banpu should have a SET market multiple of currently around depressed 6 and hence, thaistocks.com price objective is above 35 Baht per share.

The consensus says Arch will lose $0.50 per share this year as it continues to recover from the unexpected West Elk closure, but should recover to $0.20 next year. Over the longer term, the respective analysts expect both companies to achieve a strong 20% earning growth, but Banpu’s positive earnings momentum is much closer at hand than Arch’s.

Market Pricing. Valuation based on current year estimated earnings indicates both companies are undervalued relative to their prospects and peers. Since Arch will not have earnings this year, we look more closely at the ratio of price to cash earnings (or EBITDA). Arch’s 1x and Banpu’s 1.5x are both substantially less than Merrill Lynch’s mining industry average of 4.4x.

Arch’s price to book is value is 1.2x, while Banpu’s is just 0.5x. Moreover, a number of Thai brokerage analysts believe that Banpu’s net asset value is far greater than 40 Bt per share, which would make an investment in Banpu even more compelling.

Financial Health. Banpu carries a fairly normal debt load. Cash generated from its recent sale of COCO – estimated at Bt 325M – will reportedly be used to reduce the outstanding debt. We estimate the debt to equity ratio would then be 30%, which is a comfortable level.

Compare that to Arch Coal’s 500% debt to equity ratio. Now that’s what we call a highly leveraged company. While high leverage can translate into fast growing earnings, it also poses substantial risk in uncertain times.

Analysts are predicting the same 20% long term growth rate for each company, but it’s clear that Banpu’s predicted growth can be purchased at a lower cost and at a much lower risk, when risk is measured by the degree of leverage.

Return to Shareholders. Arch’s projected 1.1% net loss this year translates into a magnified 6.6% negative return to shareholders – magnified because of the aforementioned extreme leverage. Banpu’s projected 11.7% profit margin should translate into a better-than 10% return on equity this year.

As we expect from Thai companies, Banpu’s current dividend yield is a fat 5.6%. Most intriguing, though, is Arch’s current dividend yield of 3.3%. It must make for some interesting board of directors meetings when a company that is losing money and is under a mountain of debt uses its capital to make a dividend payment.

Conclusion. Thaistocks.com believes Banpu is a compelling story. Thailand’s energy sector is poised for strong growth, and Banpu is positioned as a leader. Paul Renaud also believes that the market has decidedly undervalued Banpu’s operating assets. When compared to an American counterpart, Arch Coal, Banpu goes head to head on performance, but at a better price and less risk. By Robert Thayer CFA. Trading. Banpu’s share turnover equates to almost $400,000 per day. Arch’s is double that, but relative to their market caps, Banpu is the more actively traded stock.

Trading. Banpu’s share turnover equates to almost $400,000 per day. Arch’s is double that, but relative to their market caps, Banpu is the more actively traded stock.

Best Personal Regards to all Valued Subscribers,

Paul A. Renaud.