Growth explodes valuation. A mid year min-review.

Growth and Valuation and a mid year recap.

In articles long past I used to write on growth and/versus valuation. In finance we learn early on that something which grows twice as fast is worth 3 times as much -and then some.

Exponential growth is a powerful yet simple concept which many do not understand. It happens in nature as well for example when bacteria start multiplying at ever increasing rates. Besides high dividends, I always seek out stock-choices which have a legitimate likelihood of high future earnings growth. Look at DEMCO’s earnings trajectory into next year and beyond. Here earnings are expected to be buoyant if not “explosive” -and for some years to come.

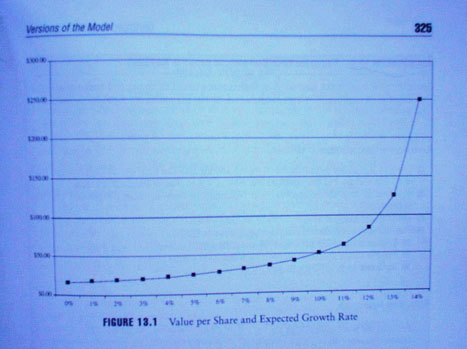

Longer term high growth commands a substantial premium in rational p/e ratings as the below graph picture shows. The picture/graph, sorry if its not so clear, is from a finance textbook. It shows how a company growing at say a 5% long term growth rate makes its stock is worth around 25. But if the annual growth rate were to increase to 14%, its value would jump to 250! The theoretical value of the stock jumps ten fold even while the growth rate barely tripled! Note how in the graph (y axis) jumps sky high once a growth rate goes into double digit levels.

This is the reason to be very focused, as I am, on visible future growth in earnings growth rates. Financial ratios and more is all important, but for rational valuation purposes, nothing so like its future growth rate. If we can get the high growth in earnings rate right, we can rationally see a surge in valuation at some point. Of course the SET is not always rational and often takes time to recognize this, but the fundamental truth and the math beyind it remains unquestionable: high future growth rates can and should propel a stock to much higher valuation levels.

Its totally reasonable to expect DEMCO will in time get a higher p/e rating then other companies in the energy sector because its growth rate is explosive compared to the other “big boys” listed in that sector. Higher average trading volume, higher market cap (now at $91 mill, or very close to the milestone 100 mill. US$) all breed well to for a higher p/e valuation. If we assume earnings of 0.60 EPS this year -and a p/e of only 12- we come to 7.20 and this for now is my price objective for DEMCO.

Hence on DEMCO I remain with my strong buy view despite its over 30% price rise since late April. We can also expect a nice interim dividend to be announced later in August. Anyway, I have for us identified several earnings growth stocks and so continue to like CITY, STPI, SYNEX, PYLON and ASIAN which I will try again to visit in person later in July. On PYLON I here made it clear a month ago to favor the PYLON-W1 when they were trading around 2.25, or some 20% ago, but/yet I still like these deep in the money warrants at the current price of around 2.66.

CITY (2.90) appears to be on a nice earnings turnaround which is likely to continue. CITY has some baby companies in the pipeline which they will want to bring public at some point, similar to UKEM a while back. This stock has already increased nicely from slightly above 2 Baht, when I first re-mentioned it in our member lounge a few months ago, but my take is it has further to go. I expect a 5-6% dividend on CITY, by Christmas.

STPI (28), I need to re-visit but it’s a great engineering company/story and I am willing to bet it too has a bright 2013 future. SYNEX I will try hard to revisit in 3 weeks, but I think here everything is on track. PYLON I view getting it back on the price correction, as stated.

My two turnaround stocks for this year are JAS (3.06) and SMT (8.25). Both companies have a mingled recent past (one due to floods the other due to a long history with now defunct TTT) and as the market realizes the earnings will be turning around next year, so should their stock prices. Last year I was dead wrong on CIG so now am a bit hesitant on picking turnarounds; hence you may want view these picks a bit more risky and a slight deviation on the strict value investor concept.

JAS has a market cap of over 800 million US$, so it’s a large cap and in many ways has already turned the corner. Its often wise to always have a large cap in the model especially if the thinking is SET bullish. Hence JAS is bit more tame and SMT a bit more wild. and together they may tango. But if on top now the EU gets a bit out of its doldrums as it looks to me and SMT delivers, this stock could have a huge bounce back to near its former glory. Leading Broker Kim Eng late last week came out with a long buy view on SMT and thinks this company can earn 1.30 next year, per share. (EPS). Hence a price target at some point of 13 looks reasonable.

On SITHAI (16) I am now more neutral as the stock has risen some 60% just since my adding it to the March 19 model -and so I am getting ready to take profits next week which is the likely right thing to do. Or, at least to just nibble out of it above the price of 16. I realize that the SET often gets irrationally greedy when it discovers a new “love affair” with a stock and that in the past I was often early in viewing taking profits. How do we know its not there already with SITHAI? If I had a superb new idea I would feel no hesitation to just switch but most of us own enough DEMCO already and SMT is a bit more of a risky call. The others mentioned here today I all like combined equally as I don't know which will be the big winner. Also, I plan some company visits in 3 weeks so will await on that before making any bold choices. I am still awaiting on management of DEMCO to give us a date when we can go visit some windmills.

It is higher future earnings growth rates, more then just about anything else which will propel a stock to lofty higher levels -and so this is what I have always sought out here. Its where I differentiate myself a bit with the traditionalist pure value stock investors. The strict value investor looks at cheapness and high dividend yield and good conservative financial ratio etc…, believing getting the high growth rate right is far more difficult to project.

Higher then average visible earnings growth rates with good companies in sectors which we think have an increasingly attractive future, is my core motto/obsession. But first, you got to beat the moribund consensus and see what the rest mostly does not see yet. Just now the market is starting to finally wake up to Thailand’s viable high growth green energy industry and while in time this may/will become overdone and so exhausted, here in Thailand at least, we are far from that point yet! DEMCO remains the right choice with the right management and far in advance to the rest and at the right time. Hold tight while asking yoursevles why dit not more investors see this month ago? DEMCO's earnings explosion has just begun and very likely to continue. The e (earnings) of the p/e ratio will propel this stock higher and a p/e expansion even more, as the company grows both in market cap and in earnings. Call this the double whammy and hang on.

While these words are dangerous it appears at mid year 2012 the EU situation is at least now not getting worse. Not that this means an economic recovery is entrenched there, but more like the Armageddon scenario has been avoided. The current Thai government will be ousted if the floods devastate the country again this year. We think they got the message loud and clear on this, along with the affected companies. Interest rates and inflation remain tamed and even the global price of oil seems to be more stable this year. For the US entrenched politicians it will be more important then ever for the US economy to show economic progress for the rest of the year.

All this makes me fairly confident that a bullish view on the SET can be maintained for now with of course my choices dominating over a prediction of any SET index level.

Best Regards,

Paul A. Renaud.

www.thaistocks.com