GDP versus Bank loans, the evidence.

More must be done.

We respectfully disagree that the Stock Exchange of Thailand is doing all it can do to promote better savings disintermediation. Below is the evidence on why much more should be done or at least evidence which points out something is clearly lacking.

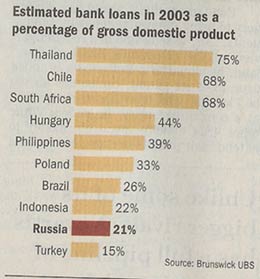

The graph shown below is clear on how inefficient the Thai capital markets are and remain to be so. By mostly relying on Bank loans both savers and investors or missing out.

Indeed, Thailand has a very high Bank loans per GDP rating, worldwide.

This simply means that mighty important equity capital is not circulating enough to grease the economy to the extend it could and should. It so also means the tools of capitalism are not fully utilized and savers and employers of capital are not well synchronized -far from it. "Prime Minister Thaksin things are out of balance here".

It also shows more then anything that while the SET authorities seem happy to pad themselves on the back on doing plenty, the proper disintermediation of savings is at a marginally lowest level in Thailand. The Thai economy is not running on all cylinders and yet the authorities seem content that enough is being done. Far from it.

This also indirectly shows the vast opportunities stock market investors have in accumulating deep values with unusually high cash dividends, as the Thai Kingdom has allot of catching up to do. Will it?

In the meantime collect high dividends by favoring these kind of shares.

Paul A. Renaud.