Fishing for a bottom.

Another big crash -and yet again induced by the developed Western economies. They mismanaged the Greece problem -and now they got the cancer.

Nobody knows how it will all work out but we got to be near the worst? While I wrote much about this of latee, my shortcoming was that I was not negative enough on that risk and how it would end-up affecting developing countries. Thailand seemed to hold up well until mid September and then it all just got just too much and it caved in mostly because:

1) Western fund managers just dumped Thai stocks (and all developing countries) just so to cover their problems back home. In the US press they describe it as selling out the more volatile markets.

2) Too many Thai investors (Thai’s and foreigners) just don’t at all understand the companies they invest in as they are short term traders -and the brokers cherish this as they want them to trade. So then just run-out indiscriminately, like scary stray dogs. If you understand and like what you own/invest in, as we do, you tend to hold on as you possess solid firms with low debt levels besides higher dividends, not just symbols. Remember, a stock is really worth the net present value of all its future dividends, not what the nervous nellys just now think!

The Thai brokers rarely make any efforts explaining the companies to their clients. Just look at their research reports, its most often just number analysis, profit margins on the last quarter etc... Instead of a good explanation what the company actually does and why its successful a leader -and likely to remain so. Hence most “investors” there just put their speculative capital in stocks, instead of serious investor capital.

Combined you so have a scenario where people just sell out and walk away for the above core reasons. So be it and I used to think years ago this would change but it has not! As we just see again.

So many good Thai companies are now trading at a ridiculous low valuation that it makes one want to whine...while I took off, so not to keep pounding the table on the way down (which I feared I would do), I now can see we must be very near a bottom! We just don't know how the EU horror will work out from here, but my sense with the SET at 855 is that the tragedy here has to be or very near, already priced in! But not if the Western banking system freezes up again like it did in 2008. At this point I don’t see this happened and after traveling some in the US, I also don’t think there will be a renewed double dip US recession. Remember next year is a US election year.

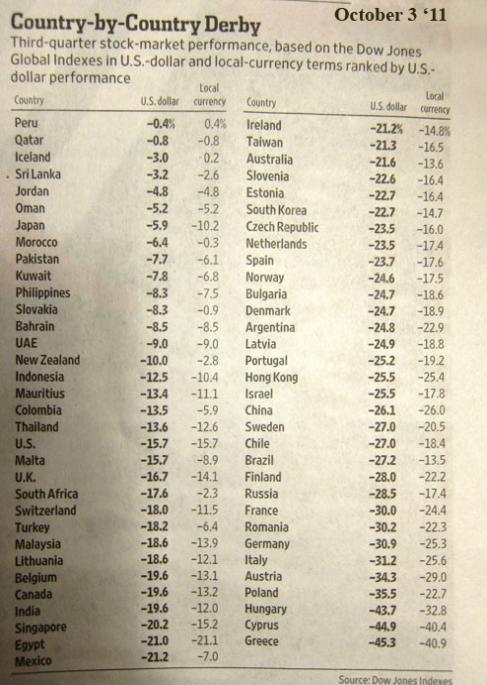

There was a global table in the US Wall Street journal edition yesterday and it showed how many markets have done much worse then the SET, year to date. Thailand still showed being in the top 1/3 of the least bad markets. Germany, a EU stronghold, did among the worst! (See below).

I still think Thailand GDP can grow 4-5% next year because its strong internal dynamics. Surely inflation will now slow (always stated as the big villain not long ago) and as we saw there was no refugee in the precious metals or commodities! Silver a big favorite among many, took among the biggest hit. Gold is still up for the year but it did not hold up as insurance as it was sold to be by most all investment managers/advisors. Gold is also down close to 20% since the deluge started.

My call today is that its time to double-up for those whom still have some gun powder and stamina as there is a huge fire sale going on just now on quality Thai companies. Surely MAJOR, DEMCO, SMT, TTCL, WORK are some of them that come to mind, but there are many others.

It is shameful what the US leaders/regulators/banks allowd to be cooked-up which then exploded in 2008, and now as well with the EU. But unlike with the US in 2008, I don't think the bank lending will freeze up globally, as it did back then.

Again, I am sorry to all members I did not see it having such a detrimental effect on Thailand; I was just too focused on how well our companies are doing and that in fact Thai politics is more stable then in a long time, despite all the noise. Not much has changed on that and so I am holding on. I was told by DEMCO in early September it should report revenues of 800 to 1 Bill Baht, for the 3rd Q., which will be a dramatic improvement over the last Q., and this should continue for many quarters. Sorry for the repeat but I for one am glad to be hiding it out much with DEMCO going forward. What I dont' know is if it go effected by all the floods? So I will write them today and ask, but regardless their mega wind project continues and has the least of all to do, with EU and USA troubles. Demco would have held up just below 4, had Europe not fallen off the cliff as bad as it did.

In the meantime, don’t get too depressed as we all here still have the realistic hope to get our 4-6% in dividends going forward while waiting out this latest crisis…and that is more then in local bonds or bank saving accounts. We live in these “new normal times”, where we stock investors must tolerate at times -30% paper loss swings and live through it, so to at some point in the future post superior returns. A loss is not a loss until you sell. That is the beauty with stocks, they mostly do come back -where defunct bonds never do. We are faring better then most European investors and because we have higher then average dividend yields we get paid while we wait.

Best Regards,

Paul Renaud.

Country by Country up until the end of the 3 Quarter 2011: