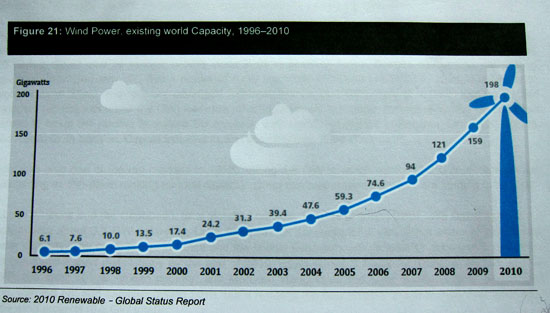

Exponential Growth in Wind Energy.

Wind and Solar Energy is a high growth business for some years to come.

DEMCO is about (this Monday or at latest Tuesday Nov 15th) to report its 3rd Quarter earnings results. Before this, and as a sign of confidence to you all, yet again, I want to hereby reiterate, one more time, my strongest buy view on this company. Its not just that I like wind energy, its that DEMCO will reach huge earnings from building this over the next many quarters.

Mind you all that this 3 Quarter will mark the first one on which their mega wind project got started, construction wise. Revenues and profits I fully expect should be impressive as we know this jumbo project is in full motion since July -and that neither the floods, its aftermath nor the EU mess, will have any effect on it! In fact the company kept on announcing new non- wind related contracts (mostly Solar) all along -and its backlog is at a stated record 9 Billion Baht. To my knowledge no Thai or other broker to date has written any research on DEMCO. As we know these guys are not really interested picking longer term winning stocks for retail clients, they are interested in generating trading commissions on noise besides catering to the institutions. Most all Thai brokers I know are only shortest term oriented and so stubborn/stupid at that! Besides nonsense talking by one analyst, no broker has shown any interest in DEMCO this year. Shame on them.

“This is just amazing how the market does not pick up on this. The price defies all logic! “ A member comment on our lounge last week.

DEMCO’s earnings prospects and so forward p/e rating ratio is tame this so only due to lower share liquidity, lower or no analyst coverage and so not well understood by investors regarding future long term high growth rate of its earnings -and why this is so. I tried to have Bualuang’s senior there get interested but when the Thai floods came everything on that got washed away & forgotten with all their market bearish disposition since. And this so persists, even while the SET index has bounced back nicely of late. Perhaps you can’t blame them but I have kept up telling you all along to not panic out and favor this core choice.

I just searched the Bangkok Post and there is not one entry about this company. Shame on them. FYI, DEMCO will give another "Opportunity Day" SET presentation on November 29th, starting at 13:15 PM.

I know for a fact that this massive wind farm is not in the flood zone -and its proceeding as planned! While DEMCO’s stock price never moved much this year, it did outperform many others since this latest market correction which started at the end of April. Since the Thai market high in April ’11, its down 25% -but many “big analyst choices” are down considerably more.

Shame on me -and sorry to all members- that I too got talked into on viewing favorably in owning some AJ, (but less on PTL and not on IVL) by those highly rated highly paid big cap. analysts. At least Ms. Pongrat is no longer at Bualuang! (Not only did she adore those AJ’s but she kept spreading wrong information on DEMCO, and this so even when she was corrected).

Many have wondered why the SET index is holding up so well, considering all the flooding misery. One of the things which the market may be sensing now is a new galvanizing Thai populous and their leaders… which will at this time all work together more while spending huge amounts of money (Thailand has over 186 Billion US$ in foreign reserves) in new infrastructure. They got the message -and it is stop arguing and instead start working together in a smarter & better way, or we will all flood in the future.

Best Regards & Happy Weekend,

Paul A. Renaud.