Drought looming in South Western USA?

Is a drought looming in years to come in South Western USA? The driest US states are also the fastest growing.

The US is full of people on the go. They are everywhere -and most places are crowded. The airports are packed and the planes are full. The roads are jammed with cars and much of the general infrastructure has to accommodate 1/3 more people, more on he go then ever, then it did when this was built many decades ago.

If you go to a Restaurant you will likely await to be seated and a tip on top of your bill of now approaching 20% is the expected norm, that is after your crowded experience with often long waits. I visited one huge vitamin store where there were some 18 people waiting to be served by one single employee, whom was the product expert, as well as the sole cashier.

In USA the average time of commuting to work (and back home) has more then doubled over the past 20 years...and the number of people commuting 90 minutes or more, each way, has doubled in just the past 10 years approaching 5 million people nationwide.

Today, with twice as many US people age 65 and over then in 1980, that crowding drag is likely to get worse. For the most part older people there no longer want to retire so soon, they want to keep working to stay connected and mentally and physically active. After all, plenty of studies have shown that an active body and mind are key to extending the healthy years. The projections and so building for retirees to circle golf courses all day are likely to be in a glut. USA roads, cities, airports, shopping centers, restaurants etc..are crowded and it will get worse. For the most part, the old are not retiring, they are traveling having fun and many keep working!

There are also many studies which show the US population (and not just there) is in love for a house, a yard and a quieter life, no matter what the cost in money or time, hence why so many are commuting ever longer time. "Boom in the boondocks" was the subject of an earlier article I wrote on this, where I predict nice homes in remoter places will do well going forward. See the below shown link for that article named: "Emergence of Exurbia and Resort Squares".

http://www.thaistocks.com/index.php?name=News&file=article&sid=846

What places in the US stand-out, i.e. offering much potential for this new life style and trend over say the next 3-5 years? The SouthWest is the obvious place to many, or is it? But not Phoenix, Arizona as it has a nightmare traffic problem and heat is obnoxious...no, not Las Vegas either as it re-invented itself away from being a family resort and endures a big crime problem. Texas is flat as a pancake and is less charming. Dallas, Texas is a huge metropolis now with some 11 million people living in that area so hardly the refuge many seek. Houston is also too big and overly humid and similar in traffic jams galore.

As suggested in my just previous article, my choice for the first signs of a likely real estate resurgence in USA is the Albuquerque New Mexico region. This city rests in an upper plateau at 5,700 feet or near 1600 meters above the Ocean level. Hence its climate is dry and less hot. The traffic is modest, the people patiently friendly and the commercial environment full of southwestern art, which is addicting.

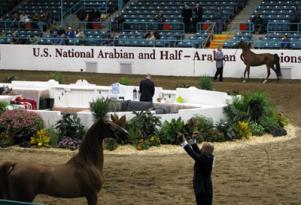

There are plenty and varied outdoor activities and nation wide grand shows, like the US National Arabian Horse show and the largest hot air ballon festival -and for what its worth- golfing there is the least expensive place in the US, but I don't have time to play golf.

If you like humid weather and a lush green environment all year round its not for you, but New Mexico is a serene place in nature with a progressive governor (running for US president but not likely to succeed) with many & varied breathtaking views, history and drives, besides great ski mountains within a short driving distance. Its a coming boom town with a quality life style besides, for US standards, rather modest real estate prices. New Mexico has culture and history, so often lacking there. What then is the negative then?

The US West is the fastest growing part of the country, but its also the driest. Looming climate changes could be making things worse in years to come. "The Future of the West may be drying up", as was described in a long cover page article in the New York Times Magazine just published of October 21 '07.

The US West is the fastest growing part of the country, but its also the driest. Looming climate changes could be making things worse in years to come. "The Future of the West may be drying up", as was described in a long cover page article in the New York Times Magazine just published of October 21 '07.

Diminishing supplies of fresh water might prove a far more serious problem than slowly rising seas. A greatly reduced river (Colorado River and Rio Grande River) could wreak chaos in seven states: Colorado, Utah, Wyoming, New Mexico, Arizona, Nevada and California, the articles states. According to one quoted source the flow of the Colorado river is at the lowest in 85 years...and huge 110 miles long lake Mead near Las Vegas is 49% empty and it would take decades to fill it back up, if the Colorado river flow went back to normal, but its not. The just consider the wild fires just now flaring-up in Southern California, most all due to dry weather.

On my recent visit, I noticed only a sporadic effort to conserve water. The Marriott Hotel we stayed had a toilet which kept running and in none of my various home visits did I notice any water conserving toilet, by far a huge water gauger, on any standard. I ask: where are the water saving/economic toilets in SWestern USA?

Its beyond the scope here to review the 15 page NY Times magazine article on this potential drought, but it at the very least it diluted the investment conclusion for the medium term Except to say that the one attractive area in the US for a real estate and economic leadership resurgence next year and beyond, is also the driest with a potential drought induced crisis. Of course there are other places in the world which have this problem, like Melbourne Australia an often much touted place, yet last year they too had a huge drought. Scary.

Assurances of fresh water going forward surely is one key barometer to try to evaluate before venturing far away from Thai stocks, as an alternative investment -if not lifestyle. In the meantime after this distraction, back at the office here, I am firmly sticking to Thai stocks as having among the best investment potential in the world, going into next year 2008, post Thai elections.

Best Regards,

Paul A. Renaud.