Besides very little share dilution for this year; we can comfortably predict 90% or more of the Warrant #4 will only convert by expiry in Feb 2013. I continue to see impressive and sustainable earnings growth in DEMCO over some time to come and so am maintaining my buy opinion despite its 2.28 X rise in value from exactly one year ago.

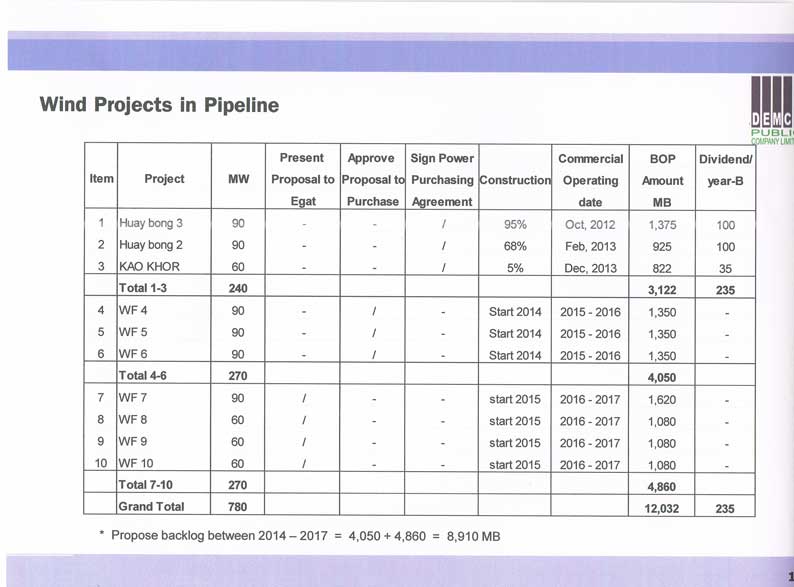

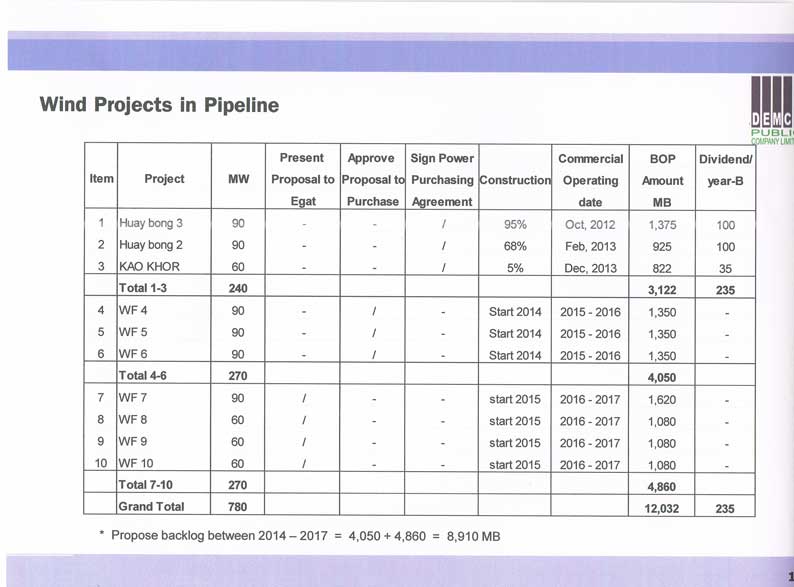

Now that it is getting near completion of its first 2 mega projects its worth remembering that DEMCO has a number of huge more wind jobs going into 2014. See below the list given to me. Here you see the 12 Bill. Baht totals which have been planned from the start. T

These megawind projects are to last for 3-5 years where the last 2 year phases are even larger then the current. Note how the progressive annual growth in total revenues is expected at 25%. Well before the end of these DEMCO will be the leading specialist in such renewable energy including others to come like BioGas. DEMCO is increasingly the Thai leading on balance of plant operator of such large green energy ventures. The members whom visited the site with me could see the vast land mass up there and how the wind blows all year long.

In the meantime the company’s core business is growing as well -not least due to the mega 4 Bill. Baht in expected outlays and gear to get Thailand to true 3 G and 4 G -now to come. DEMCO’s steel fabrication plant can produce at max. 600 mill Baht a year of higher margin towers and related equip. installation for this. And new capacity can be added for little capital (20 to 30 mill. Baht), as they own extra land at the site already. They can gear this to 1 Bill. next year revenue if called for. 3G related revenues are at a higher +25% gross profit margin. As EGAT announced large upgrades to electric transmission lines, yes this will directly benefit DEMCO as well. These and more growing core businesses are typical of 6-18 month projects life and so never reflect reality after that.

Here it is how is was described to me “.The existing business of Demco is to construct substation, transmission line , underground cable , mechanical installation which are normally completed project within 1 -1.5 years. So,in reality, the backlog record is no longer than year 2013.Anyway, the backlog prospect for year 2014 ( exclude wind ) will come from bidding with PEA ( budget around 7 billion) , SPP firm ( 12 projects , budget approx. 1 billion ) Solar farm ( 60 MW ,budget EPC = 4.8 billion or E&C = 1.4 billion ) . “

Of the total of ten planned wind projects only the first 2 are now near completion. The 2 completion rates as of Oct 1 is shown in the table below. The proposed backlog between year 2014-to 2017 (displayed at the bottom) is shown at 8.9 Bill. While I don’t believe everything in print and we know these projects are not iron fist “money down” guarantees; yet it is all very likely all to proceed due to stated government and EGAT strong desire/goal in broadening the power supply base. Why should DEMCO tie up capital for projects which are not starting until 2014? But they are very much planned and the reasonable reality because the Thai government’s pro-green energy tilt and the dire need for the country to diversity its growing electrical power growth needs which is growing at near 7% per year. As was well pointed out in one our member postings here today quoting the Bangkok Post.

While wind energy is not likely to be the forever long solution, but it has a firm grip on making a meaningful contribution for years to come. I remain confident for now we are at the beginning of such a half decade or longer upward move before a new green plateau here in Thailand. Also that this country has learned at least about some of the mistakes other countries did. These may come to haunt one day here as well but we are far from that.

With mega projects in hand, the core business doing well, the first mega wind energy project ahead of schedule and now near completion, and electric rates just raised 5%, I can see DEMCO to up its growth in revenues and net earnings momentum along with above average dividend yields.

This company’s skill and expertise will allow it to excel going forward while reaping nice tax free benefits from the projects it takes a % with. As it did with its 27% ownership in AELOUS Co. on this year’s two projects. BTW, Demco already paid 1.2 Bill. Baht of the 1.3 Bill it owed. This is likely why they made the SET announcement last week to cancel the capital increase; this company does not need to raise capital at this time -and the managing director is only 54 years old and will not to retire before age 60.

I think next year’s BOI tax free dividend could be closer to 235 mill. Baht, not the 150 now projected. The KAO KHOR project, a 60 MW project, will start later this month after expected cabinet approval - so in weeks. DEMCO will continue to be the balance of plant operator on all this and I think their net profit margins can improve even more as their now experience make things easier for the next rounds. The company’s stock price p/e should expand not least due to higher market cap. and trading volume besides the myth quenched that next year’s earnings could be at a peak. Unfounded and here refuted and so my buy view maintained.

Thailand is just at the start of such a clean-energy boom vs. various more developed countries’s have stalled after thriving for years. Past examples show how some over built along with too high and unsustainable govt. subsides, or the opposite: of destabilizing with on-and off tax incentives like in the US. Why should governments not give some small subsidy when they are producing totally green energy vs. alternative which pollute but then these do not pay for this pollution we all must endure. Thailand seems to have found the right mix.