DEMCO at SET Opportunity Day.

Here are the key points from their presentation with Questions at the end.

Quick notes on their presentation: Up to date back log is at record 9.4 Billion. The company expects revenues to grow 55% this year, over last, or to a record.

Then, "grow another 50% over that in 2012" as the MD said, or so to another new record of 6 Billion. Realize that the wind project saw only some 220 million of revenue for the 3 Q., so more is pushed into next year, as phase two is not starting until mid December. (Huabong #2).

Solar and repairing flooded substations is the new good margin business.

Based on all this and then with a rough "back of envelope computation", I can see 4Q. net profit to near double over the 3 Q. on 1.7 Bill of revenues. Realize this over the already excellent 3 rd Q. of 0.12 Baht per share profit, or so to around 0.40 per share for all of this year.

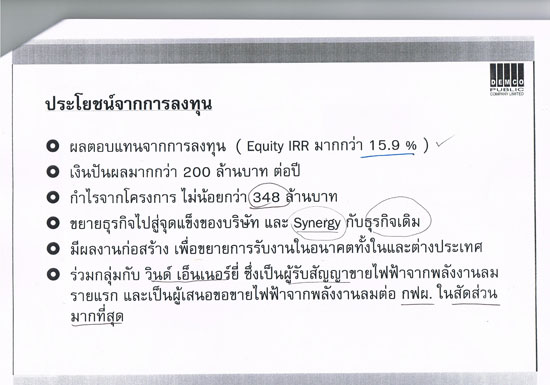

Next year net profit should double again but there will be some share dilution due to warrants 3 and a likely capital increase by mid 2012. But as you know in calender 2013 some 200 mill. Baht in dividend income will flow to DEMCO on their by then completed Wind project. I would expect a 0.18 Baht dividend in April '12, or near 5% on the current price. Very respectable for such a growth company well removed from recessionary feared US/EU and with entrenched large contracts in hand and bank financing all secured. Mgt. re-affirmed that the total 2 wind projects is not and cannot be late and expected completed next year.

All sounds very upbeat with little competition and little execution risk as the company has the manpower in hand and much of the preparation work has been is done. Also their large “completed but unbilled work” amount of 1.1 Bill. should drop next year as 40% of this comes from the electric authority awaiting final testing. All a good report from management and a re-affirmation things are on track, backlog is increasing and no effect on this company in regards to Thai floods, except for some new high margin business on rebuilding substations where an announcement is imminent.

Nothing was said about why the company still has no brokers follow or write research on them.

Best Regards,

Paul Renaud.

Note the high IRR expected on this wind project -and the over 200 mill. in expected annual wind dividends from this to DEMCO, by calender 2013. This page of the hand out was given to all present shareholders, at their extraordinary shareholder meeting, in late June of 2011.