BRR, Buriram Sugar, buy view here is why.

Buriram Sugar Public Company Limited, buy view and here is why:

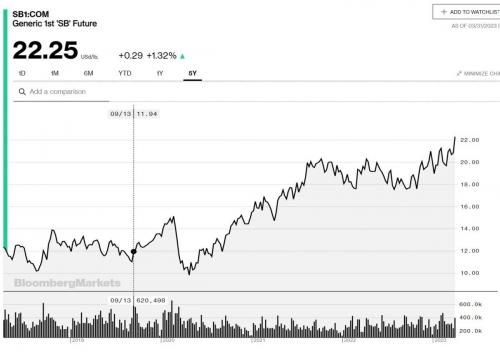

BRR (6.25), revenue dropped significantly over the last two years from 5.8 Bill to around 4 Bill. In 2021, but last year 2022, it roared back to 7.5 bill. With net profit soaring back as well, from 272 mill. in year 2018, to 767 mill. for last calendar year. (EPS from 0.33 Baht to 0.94 Baht per share. Hence at the current mkt. price BRR is trading at an undemanding p/e of 6.6, with a book value of 3.2. What is missed is that global sugar prices have soared of recent continuously to 5 year highs and the company is diversifying into promising more stable related ventures.

The previous bad years was the result of the drought situation, the slump in sugar prices in the global market and not least, the slowdown in the economy caused by the COVID-19 epidemic, and the beginning of BRR investments in new businesses, such as the bagasse packaging*. All these events (setbacks) are now well past and in my view the future profitability looks promising, not least due to recent global firm sugar prices. (see graph here, global sugar prices at 5 year high).

BRR must reserve cash for working capital and new investments in order to diversify its business lines and stop depending solely on the sugar business so to create sustainability in business operation. This is the key reason why its latest dividend announcement was a bit tame, at 0.20 Baht per share, with XD date on May 12th., or for a current yield of 3.2%.

BRR plans to invest in an additional 14 machines in order to increase the production capacity of bagasse packaging*, including the investment in new projects of wood pellet in Thailand, as well as the improvement of refined sugar production for its 3-year investment strategy. BRR expects the potential for its growth due to the global trend toward adopting environmentally friendly goods and the usage of biomass fuels to replace fossil fuels and coal, particularly in Japan, which is their top market.

The amount of wood pellets imported into Japan in 2018 was 1.61 million tons and this, according to the company, is growing at an average rate of 40% annually.

The company has stated it conducts business with consideration for the interests of our shareholders, excellent performance, sustainable business operation and good corporate governance.

More on their just recent past performance:

For the year 2022, the majority of revenue consisted of the following;

Sugar business was 78%, of total revenues

Fertilizer business was 8% of total revenues

Electricity business was 6% of total revenues

Additional businesses of some 8% of total revenues, namely: packaging business, logistics management business, fuel trade, and sugar cane harvesting business.

BRR has set the investment budget 510 million baht for the next three years that will invest primarily in its core businesses, such as sugar and two new businesses; packaging and wood pellets which are their New S Curve business. Such investments are forecasted to generate sustainable growth in the future, according to the company.

BRR has set a 3-year and 5-year revenue goal of 8,095 million baht and 10 billion baht respectively which will be accomplished by encouraging stability and sustainable growth across all its industry sectors. This in time I believe could double it’s p/e ratio as BRR will be viewed far more then just another commodity biz. Post checking, I do not see any reported buy/sell insider transactions, for this year 2023.

BRR forecasts approximately 8,095 million baht in revenue in the next three years. The sugar business, the packaging business, and the wood pellets business will contribute performance to the achievement of the main target. This is their 3-year business plan which they disclosed the in the “SET opportunity day” event, on March 20, 2023 and to the media: https://thunhoon.com/article/269926 https://www.youtube.com/watch?v=hOaHzb1pQ4Q

Here are some links/resources, websites and charts to track world sugar prices, note you may have to be a subscriber

to some of these as I am, but see my graphs:

https://www.spglobal.com/commodityinsights/en (S&P Global Commodity Insights)

https://www.bloomberg.com/quote/SB1:COM

https://www.investing.com/commodities/us-sugar-no11

https://www.investing.com/commodities/london-sugar

***

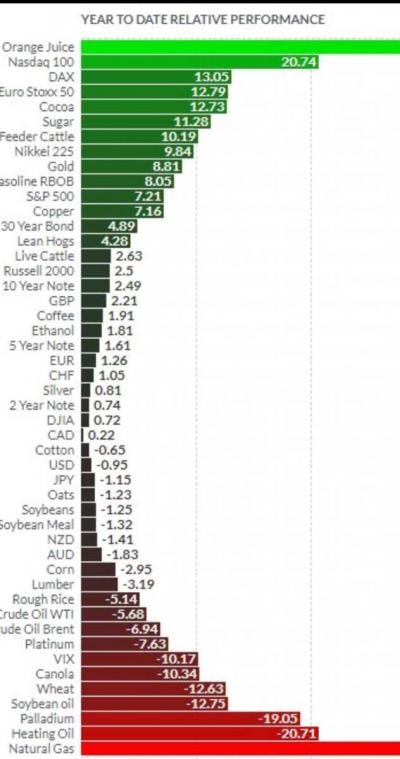

BRR has two outstanding warrants which got my interest, but not for investment: BRR-W1, is convertible at 7.50 Baht, 1 for 1, but expiring soon namely, already on 11 of August this year! This is interesting (more below) as it would seem the company is so very motivated in having these converted by then, and it will only happen if its stock price is above 7.50 by then. Because it intends to use BRR-W1 conversion as new capital for working capital for its operations, which includes loan repayments. Initially, on a short-term basis, the Company requires approximately 1,200 million baht to support the investment in the sugar business expansion, as well as to use as working capital to support the increased production and distribution of sugar in terms of high price and quantity. The table here on the right, is as of end of March, note how Sugar features in the top 6 top performing commodity so far this year!

BRR -W2 is far out-of-the-money, convertible at 13 Baht with expiration date of Feb 13 2026, so almost 3 years to go. The stated objective of BRR-W2 is to prepare and strengthen the Company's financial standing. Future expansion of projects related to the Company's existing business, such as investment in expanding packaging production capacity. Including developing investment in the Wood Pellet business, for which feasibility studies are currently being conducted. BRR needs approximately 1 billion baht in the next three years to reserve cash for future working capital needs.

I view BRR (6.25) common shares as undervalued and hence would label it with a solid buy view, due to strong global sugar prices, new desirable diversification and the likelihood BRR-W1 will be converted by August ’22, along with a 0.20 Baht dividend to be earned in the interim. The BRR-w1 are more/too speculative and hence I would stick the BRR stock, as investment. Always diversify.

Best Regards,

Paul A. Renaud www.thaistocks.com* Bargasse packaging: Replaces plastic with an eco-friendly, aesthetically pleasing unboxing experience. Save time, money, and the environment with sustainable paper-based packaging