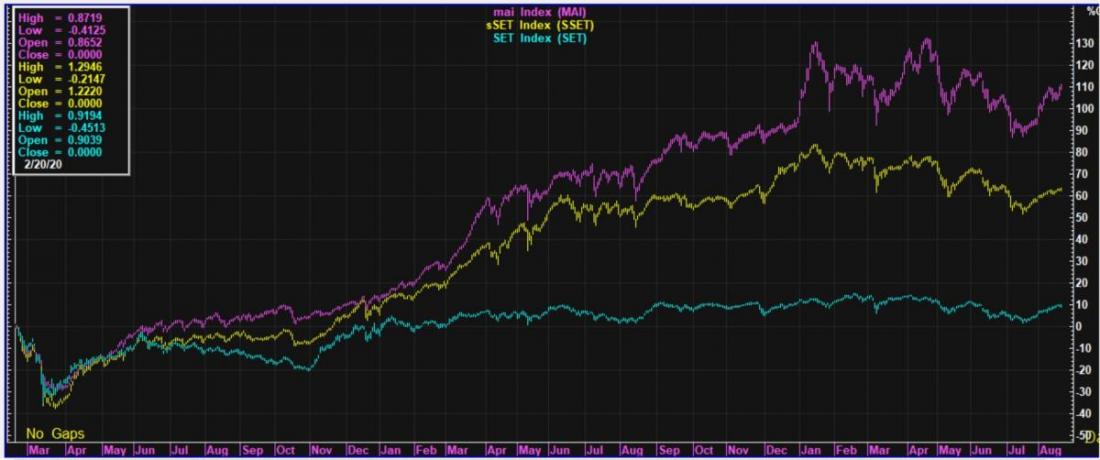

Big divergence of smaller cap Thai stocks, vs. the big cap SET index -since the outbreak of Covi-19.

Here below you can see the immense divergence of smaller cap Thai stocks, vs. the big cap SET index -since the outbreak of Covi-19. The SET benchmark index is a weighted index by market cap., so the bigger the market cap. of a stock, the more its weighted in the SET index. Here you see a 6-10 fold divergence (smaller cap's way oupeformoring big cap's overall). Yet this is never mentioned/written about neither by institutions nor brokers, nor the press. As its not in their interest to point this out, but fact is fact as here documented:

The purple line is the Mai index (a small cap index) the Yellow line is sSET index, another smaller cap index...the lowest bluish line -by far-is the big cap SET index. Notice the huge 6-10 times divergence here! Wow. To be fair, prior to this from early 2018 to early 2020, these 2 same indexes well underperformed the SET benchmark index -back then. It was a long mkt. correction in this segment back then but post many years of outperforming. As is now again -since late March 2020. (Graph is by Bloomberg).

Paul A. Renaud. www.thaistocks.com